You are here

Home ›Gas Follows Oil

Oil’s Price Increase Contributes to the Thirst for Gas

Given the increasing difficulties in its oil supply, the US’s recent energy plan has turned that country’s attention towards internal production and marketing of gas. Its subterranean reserves are considerable, although this is partially obscured by the large investment needed to exploit them and the high overall cost. In the world ranking, the USA is preceded by Iran, Russia, Qatar, Saudi Arabia and, potentially, Iraq. Now that the market price of American gas has risen by nearly 50% over the past two years, the major US companies have re-awakened. The price has reached $6 per Mbtu (million british thermal units), whereas a price of oil of around $46-47 (1) on Nymex (New York Mercantile Exchange) corresponds to a gas price of $8. Foreseeing a leap in the demand for gas, American, Canadian and Mexican oil companies (Exxon Mobil, Texas Chevron, Royal Dutch/Shell, Conoco Phillips, BP USA, etc.) are concentrating on the possibility of exploiting deposits in areas under Federal protection (parks, Indian reserves and Arctic areas). They are also putting forward the commercialisation of gas from abroad with large investments in plants for the liquefaction on land, for ships which transport lng (liquid natural gas). The areas concerned in this import activity are in many cases those already at the centre of attention because of oil: Malaysia, Indonesia, Australia, the Timor Sea, Qatar and Nigeria. Other suppliers of gas to the USA which are already active are: Oman, the United Arab Emirates, Algeria, Angola, Trinidad and Brunei. All in all, for the plants which will receive this gas and the terminals on the American coast where it will arrive, a frenetic race to carry out projects and get finance has started.

It is not just for oil, then, but also for gas, that the US energy dependency, like that of Europe and China, is destined to grow and become crucial. At the centre of the Yukos affair in Russia there was, among other things, the control over commercial treaties regarding gas, both Russian as well as Kazakh and Turkmeni. In the latest Ukrainian events (80% of the gas sold by Russia to Europe passes through the Ukraine), with the new government which looks to Germany without the intermediary of Moscow, the manoeuvres around gas have played their part. As well as all this, Russia is beginning the exploitation of the gas reserves in the Jamal peninsula (Western Siberia), in the Barents Sea, in Eastern Siberia and in the Sakhalin Peninsula. The same is true for the deposits on the border with Kazakhstan. The Russian market is also relating to China and Japan, while, in the co-production of gas with the Norwegian Statoli (Barents sea), Russian Gazprom is looking to a profitable supply of gas for the American East coast. The recent accord between Moscow and Berlin for the development of the Baltic gas pipeline which will carry the gas from the Siberian deposits to Germany, will, by using International waters, cut out Byelorussia, the Ukraine, Poland and the Baltic Republics. The gas pipeline, which will utilise the bed of the Baltic Sea, is jointly financed by Gazprom and the German company Wintershall, part of the chemical giant BASF. This will cost around $10bn. The Italian company ENI has just inaugurated a submarine gas pipeline, running from the North coast of the Black Sea near the oil port of Novorossijsk to Durusu near Samsun on the Turkish coast, which carries gas 1200km. Its maximum capacity is 16bn cubic metres per year.

In Italy, where gas sales increased by 9% in 2004 to a record of 21.5bn cubic metres, Gazprom and ENI have been “negotiating” for months now: Gazprom want to directly sell at least 2bn cubic metres of methane per year in Italy, and to join the Rete Gas network, controlled by ENI. The negotiations have been about a gigantic deal: plants for gas liquefaction in Russia and for its re-conversion into gas in Italy. At the same time, Moscow is concluding accords with China, such as that for the construction of two gas pipelines of 60-80bn cubic metres per year capacity for Northern China.

There is further manoeuvring in Latin America, where the Bolivian political events are also conditioned by the gas reserves present in the country, estimated to be around 49 trillion cubic feet (alongside 480mn barrels of oil). There are dozens of billions of dollars supervised by transnational companies who blackmailed the Bolivian government into signing one-sided contracts, which fall due in 2036, when the reserves run out. An increase in the tax on oil at the wellhead, a revision of the contracts or the nationalisation of the gas are threats which are sufficient to unleash clashes without scruple (including the intervention of the Mafia) between the factions of the Bolivian bourgeoisie and the British bourgeoisie of British Petroleum and British Gas, the French bourgeoisie of Total, the American bourgeoisie of Mobil and Enron, the Spanish bourgeoisie of Repsol and the Brazilian bourgeoisie of the Petrobas of President Lula. All lined up for the defence of their own shareholders...

Finally, in Italy, manoeuvres of ample scope have been dragging on concerning the construction of a terminal for the retransformation of liquid gas at Brindisi, where there are already large energy plants: two large centres for coal (Cerano and Costa Morena), as well as the seat of the petro-chemical firm Enel. Under an old agreement between the Italian government and British Gas, lng is to be transported from Egypt and the Middle East - thus there should be storage and facilities for the re-conversion of lng to gas at Brindisi for around 6mn tonnes per year. The inhabitants of the zone where this gas will be received, stored and re-vaporised are protesting: in addition, the docks for the ships, which carry on average between 70 and 140 thousand cubic metres of gas, require the laying of about a thousand cubic metres of concrete and the pushing back of the sea by around 150 000 square metres with very great environmental pollution. But the profits, it goes without saying, will be considerable...

dc(1) With oil price now approximately $70 the equivalent gas price would be nearly $12.

Revolutionary Perspectives

Journal of the Communist Workers’ Organisation -- Why not subscribe to get the articles whilst they are still current and help the struggle for a society free from exploitation, war and misery? Joint subscriptions to Revolutionary Perspectives (3 issues) and Aurora (our agitational bulletin - 4 issues) are £15 in the UK, €24 in Europe and $30 in the rest of the World.

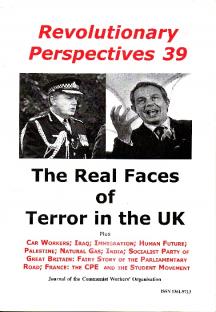

Revolutionary Perspectives #39

Summer 2006 (Series 3)

Start here...

- Navigating the Basics

- Platform

- For Communism

- Introduction to Our History

- CWO Social Media

- IWG Social Media

- Klasbatalo Social Media

- Italian Communist Left

- Russian Communist Left

The Internationalist Communist Tendency consists of (unsurprisingly!) not-for-profit organisations. We have no so-called “professional revolutionaries”, nor paid officials. Our sole funding comes from the subscriptions and donations of members and supporters. Anyone wishing to donate can now do so safely using the Paypal buttons below.

ICT publications are not copyrighted and we only ask that those who reproduce them acknowledge the original source (author and website leftcom.org). Purchasing any of the publications listed (see catalogue) can be done in two ways:

- By emailing us at uk@leftcom.org, us@leftcom.org or ca@leftcom.org and asking for our banking details

- By donating the cost of the publications required via Paypal using the “Donate” buttons

The CWO also offers subscriptions to Revolutionary Perspectives (3 issues) and Aurora (at least 4 issues):

- UK £15 (€18)

- Europe £20 (€24)

- World £25 (€30, $30)

Take out a supporter’s sub by adding £10 (€12) to each sum. This will give you priority mailings of Aurora and other free pamphlets as they are produced.

ICT sections

Basics

- Bourgeois revolution

- Competition and monopoly

- Core and peripheral countries

- Crisis

- Decadence

- Democracy and dictatorship

- Exploitation and accumulation

- Factory and territory groups

- Financialization

- Globalization

- Historical materialism

- Imperialism

- Our Intervention

- Party and class

- Proletarian revolution

- Seigniorage

- Social classes

- Socialism and communism

- State

- State capitalism

- War economics

Facts

- Activities

- Arms

- Automotive industry

- Books, art and culture

- Commerce

- Communications

- Conflicts

- Contracts and wages

- Corporate trends

- Criminal activities

- Disasters

- Discriminations

- Discussions

- Drugs and dependencies

- Economic policies

- Education and youth

- Elections and polls

- Energy, oil and fuels

- Environment and resources

- Financial market

- Food

- Health and social assistance

- Housing

- Information and media

- International relations

- Law

- Migrations

- Pensions and benefits

- Philosophy and religion

- Repression and control

- Science and technics

- Social unrest

- Terrorist outrages

- Transports

- Unemployment and precarity

- Workers' conditions and struggles

History

- 01. Prehistory

- 02. Ancient History

- 03. Middle Ages

- 04. Modern History

- 1800: Industrial Revolution

- 1900s

- 1910s

- 1911-12: Turko-Italian War for Libya

- 1912: Intransigent Revolutionary Fraction of the PSI

- 1912: Republic of China

- 1913: Fordism (assembly line)

- 1914-18: World War I

- 1917: Russian Revolution

- 1918: Abstentionist Communist Fraction of the PSI

- 1918: German Revolution

- 1919-20: Biennio Rosso in Italy

- 1919-43: Third International

- 1919: Hungarian Revolution

- 1930s

- 1931: Japan occupies Manchuria

- 1933-43: New Deal

- 1933-45: Nazism

- 1934: Long March of Chinese communists

- 1934: Miners' uprising in Asturias

- 1934: Workers' uprising in "Red Vienna"

- 1935-36: Italian Army Invades Ethiopia

- 1936-38: Great Purge

- 1936-39: Spanish Civil War

- 1937: International Bureau of Fractions of the Communist Left

- 1938: Fourth International

- 1940s

- 1960s

- 1970s

- 1969-80: Anni di piombo in Italy

- 1971: End of the Bretton Woods System

- 1971: Microprocessor

- 1973: Pinochet's military junta in Chile

- 1975: Toyotism (just-in-time)

- 1977-81: International Conferences Convoked by PCInt

- 1977: '77 movement

- 1978: Economic Reforms in China

- 1978: Islamic Revolution in Iran

- 1978: South Lebanon conflict

- 1980s

- 1979-89: Soviet war in Afghanistan

- 1980-88: Iran-Iraq War

- 1980: Strikes in Poland

- 1982: First Lebanon War

- 1982: Sabra and Chatila

- 1986: Chernobyl disaster

- 1987-93: First Intifada

- 1989: Fall of the Berlin Wall

- 1979-90: Thatcher Government

- 1982: Falklands War

- 1983: Foundation of IBRP

- 1984-85: UK Miners' Strike

- 1987: Perestroika

- 1989: Tiananmen Square Protests

- 1990s

- 1991: Breakup of Yugoslavia

- 1991: Dissolution of Soviet Union

- 1991: First Gulf War

- 1992-95: UN intervention in Somalia

- 1994-96: First Chechen War

- 1994: Genocide in Rwanda

- 1999-2000: Second Chechen War

- 1999: Introduction of euro

- 1999: Kosovo War

- 1999: WTO conference in Seattle

- 1995: NATO Bombing in Bosnia

- 2000s

- 2000: Second intifada

- 2001: September 11 attacks

- 2001: Piqueteros Movement in Argentina

- 2001: War in Afghanistan

- 2001: G8 Summit in Genoa

- 2003: Second Gulf War

- 2004: Asian Tsunami

- 2004: Madrid train bombings

- 2005: Banlieue riots in France

- 2005: Hurricane Katrina

- 2005: London bombings

- 2006: Anti-CPE movement in France

- 2006: Comuna de Oaxaca

- 2006: Second Lebanon War

- 2007: Subprime Crisis

- 2008: Onda movement in Italy

- 2008: War in Georgia

- 2008: Riots in Greece

- 2008: Pomigliano Struggle

- 2008: Global Crisis

- 2008: Automotive Crisis

- 2009: Post-election crisis in Iran

- 2009: Israel-Gaza conflict

- 2020s

- 1920s

- 1921-28: New Economic Policy

- 1921: Communist Party of Italy

- 1921: Kronstadt Rebellion

- 1922-45: Fascism

- 1922-52: Stalin is General Secretary of PCUS

- 1925-27: Canton and Shanghai revolt

- 1925: Comitato d'Intesa

- 1926: General strike in Britain

- 1926: Lyons Congress of PCd’I

- 1927: Vienna revolt

- 1928: First five-year plan

- 1928: Left Fraction of the PCd'I

- 1929: Great Depression

- 1950s

- 2010s

- 2010: Greek debt crisis

- 2011: War in Libya

- 2011: Indignados and Occupy movements

- 2011: Sovereign debt crisis

- 2011: Tsunami and Nuclear Disaster in Japan

- 2011: Uprising in Maghreb

- 2014: Euromaidan

- 2016: Brexit Referendum

- 2017: Catalan Referendum

- 2019: Maquiladoras Struggle

- 2010: Student Protests in UK and Italy

- 2011: War in Syria

- 2013: Black Lives Matter Movement

- 2014: Military Intervention Against ISIS

- 2015: Refugee Crisis

- 2018: Haft Tappeh Struggle

- 2018: Climate Movement

People

- Amadeo Bordiga

- Anton Pannekoek

- Antonio Gramsci

- Arrigo Cervetto

- Bruno Fortichiari

- Bruno Maffi

- Celso Beltrami

- Davide Casartelli

- Errico Malatesta

- Fabio Damen

- Fausto Atti

- Franco Migliaccio

- Franz Mehring

- Friedrich Engels

- Giorgio Paolucci

- Guido Torricelli

- Heinz Langerhans

- Helmut Wagner

- Henryk Grossmann

- Karl Korsch

- Karl Liebknecht

- Karl Marx

- Leon Trotsky

- Lorenzo Procopio

- Mario Acquaviva

- Mauro jr. Stefanini

- Michail Bakunin

- Onorato Damen

- Ottorino Perrone (Vercesi)

- Paul Mattick

- Rosa Luxemburg

- Vladimir Lenin

Politics

- Anarchism

- Anti-Americanism

- Anti-Globalization Movement

- Antifascism and United Front

- Antiracism

- Armed Struggle

- Autonomism and Workerism

- Base Unionism

- Bordigism

- Communist Left Inspired

- Cooperativism and autogestion

- DeLeonism

- Environmentalism

- Fascism

- Feminism

- German-Dutch Communist Left

- Gramscism

- ICC and French Communist Left

- Islamism

- Italian Communist Left

- Leninism

- Liberism

- Luxemburgism

- Maoism

- Marxism

- National Liberation Movements

- Nationalism

- No War But The Class War

- PCInt-ICT

- Pacifism

- Parliamentary Center-Right

- Parliamentary Left and Reformism

- Peasant movement

- Revolutionary Unionism

- Russian Communist Left

- Situationism

- Stalinism

- Statism and Keynesism

- Student Movement

- Titoism

- Trotskyism

- Unionism

Regions

User login

This work is licensed under a Creative Commons Attribution 3.0 Unported License.