You are here

Home ›Lehman Brothers 5 Years On: The Emperor Still Has No Clothes

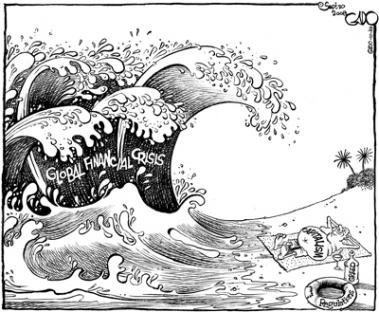

Today the press and TV are talking about the "flood" of liquidity that is almost drowning the world. However, until recently they were crying about the lack of liquidity that had given rise to the crisis in early 2000.

Just five years ago, on September 15, 2008, the American merchant bank, Lehman Brothers failed and in the following weeks the aftershocks of a financial earthquake of gigantic proportions were multiplied. Back in July 2007 it had already started in real estate with the collapse of fictitious financial constructs. The government agencies, Fannie Mae and Freddie Mac were swept away one week before the Lehman case, which was allowed to fall into total collapse because it appeared that European banks and investors were the holders of the biggest liabilities. Instead U.S. authorities rushed to the rescue of other banks and savings banks (AIG, ITC, etc.) In total 1.765 billion dollars ... Not only the Fed but also the ECB followed and pumped in liquidity, imitated by the Bank of England and Japan. Today the ECB still performs refinancing operations at an interest rate of 0.5%.

Thus five years have passed and everything looks more or less as before. The "nodal point" of the crisis (sold as such even if the reality is quite different) is tangled up with the famous derivatives games that led to so many financial acrobatics. In the U.S., the Dodd-Frank reform (Law of 2010) has been virtually stalled by the manoeuvres of the financial lobbies (especially with regard to the fantastic pay-outs to the top bank managers!).

It's true that the major banks have increased their capital, but the relationship between the assets and the share capital of each bank (leverage ratio) is still a mystery and definitely not in a position to absorb losses which would thus be passed on to the "public". Basel 3 proposed a minimum capitalisation of 3%, but in reality it would require tens of billions of dollars that the U.S. banking giants have no intention of putting on the table. They take advantage of the fact that their failure would have destabilising consequences for everyone, and as banks are "too big to fail" are sure to get the public bailouts in the event of heavy losses.

Meanwhile the Practical Packaging continues (or if you prefer, the "bagging up" like smelly sausages) of securities based on debt in the hands of others, while those who had toxic assets in their portfolio still have not sold them, thus avoiding acknowledgment of the losses.

As is well known among the "experts", the value of derivatives is derived from fictitious rates, currencies, indexes, etc.. being contracts between parties: someone who buys and sells risk, covering themselves in turn with other appropriate instruments. The main risks come from changes in exchange rates, commodity prices, the values of securities and calculation of the risk of default.

The fall in the average rate of profit, a tendency which has been underway for some time with brief upturns which the proletariat has paid for dearly, has sparked the sorcery around the use of financial instruments which are as sophisticated as they are fraudulent. This is not only a zero-sum game, but causes chilling financial shocks.

Terrifying sums of debt have carried over to today: according to the Bank for International Settlements (BIS) the notional amount[i] of outstanding derivatives (the vast majority of derivatives are on interest rates) would be equal to $632.7 trillions, amounting to over 9 times the GDP of the entire planet. More precisely: derivatives of $8.8 for every dollar of GDP! (source: World Economic Outlook / IMF, April 2013).

In 2007 their value was $596,000 billion, that is, when they were officially considered as the cause of the crisis. In 2012, the cost of surrendering these contracts, at current market prices, was estimated to be about $20 trillion. The banks with the largest exposures are American, led by JP Morgan and followed by the omnipresent Goldman Sachs.

The only choice left is to climb more and more recklessly, without a rope or metal spikes, the mountains of waste paper, bad debt, Treasury bonds, mortgages. These debts create waves of excess liquidity and sudden contractions, alternating with rising stock prices which then go into free fall. Money-capital cannot slow down, much less stop its insane movement. It must try to survive by breaking down any barriers that currently threaten and restrain both the development of the productive forces (the search for increased productivity of commodities in order to continue the accumulation of capital) and the expansion of artificial needs. But both backfire, because it requires less and less living labour to produce goods and thus unemployment spreads and the market is constantly faced with less solvent purchasers. The sound of the death knell spreads while black storm clouds are looming up on the horizon.

DC

[i] The notional value would be the underlying debt position of the derivative.

Start here...

- Navigating the Basics

- Platform

- For Communism

- Introduction to Our History

- CWO Social Media

- IWG Social Media

- Klasbatalo Social Media

- Italian Communist Left

- Russian Communist Left

The Internationalist Communist Tendency consists of (unsurprisingly!) not-for-profit organisations. We have no so-called “professional revolutionaries”, nor paid officials. Our sole funding comes from the subscriptions and donations of members and supporters. Anyone wishing to donate can now do so safely using the Paypal buttons below.

ICT publications are not copyrighted and we only ask that those who reproduce them acknowledge the original source (author and website leftcom.org). Purchasing any of the publications listed (see catalogue) can be done in two ways:

- By emailing us at uk@leftcom.org, us@leftcom.org or ca@leftcom.org and asking for our banking details

- By donating the cost of the publications required via Paypal using the “Donate” buttons

The CWO also offers subscriptions to Revolutionary Perspectives (3 issues) and Aurora (at least 4 issues):

- UK £15 (€18)

- Europe £20 (€24)

- World £25 (€30, $30)

Take out a supporter’s sub by adding £10 (€12) to each sum. This will give you priority mailings of Aurora and other free pamphlets as they are produced.

ICT sections

Basics

- Bourgeois revolution

- Competition and monopoly

- Core and peripheral countries

- Crisis

- Decadence

- Democracy and dictatorship

- Exploitation and accumulation

- Factory and territory groups

- Financialization

- Globalization

- Historical materialism

- Imperialism

- Our Intervention

- Party and class

- Proletarian revolution

- Seigniorage

- Social classes

- Socialism and communism

- State

- State capitalism

- War economics

Facts

- Activities

- Arms

- Automotive industry

- Books, art and culture

- Commerce

- Communications

- Conflicts

- Contracts and wages

- Corporate trends

- Criminal activities

- Disasters

- Discriminations

- Discussions

- Drugs and dependencies

- Economic policies

- Education and youth

- Elections and polls

- Energy, oil and fuels

- Environment and resources

- Financial market

- Food

- Health and social assistance

- Housing

- Information and media

- International relations

- Law

- Migrations

- Pensions and benefits

- Philosophy and religion

- Repression and control

- Science and technics

- Social unrest

- Terrorist outrages

- Transports

- Unemployment and precarity

- Workers' conditions and struggles

History

- 01. Prehistory

- 02. Ancient History

- 03. Middle Ages

- 04. Modern History

- 1800: Industrial Revolution

- 1900s

- 1910s

- 1911-12: Turko-Italian War for Libya

- 1912: Intransigent Revolutionary Fraction of the PSI

- 1912: Republic of China

- 1913: Fordism (assembly line)

- 1914-18: World War I

- 1917: Russian Revolution

- 1918: Abstentionist Communist Fraction of the PSI

- 1918: German Revolution

- 1919-20: Biennio Rosso in Italy

- 1919-43: Third International

- 1919: Hungarian Revolution

- 1930s

- 1931: Japan occupies Manchuria

- 1933-43: New Deal

- 1933-45: Nazism

- 1934: Long March of Chinese communists

- 1934: Miners' uprising in Asturias

- 1934: Workers' uprising in "Red Vienna"

- 1935-36: Italian Army Invades Ethiopia

- 1936-38: Great Purge

- 1936-39: Spanish Civil War

- 1937: International Bureau of Fractions of the Communist Left

- 1938: Fourth International

- 1940s

- 1960s

- 1980s

- 1979-89: Soviet war in Afghanistan

- 1980-88: Iran-Iraq War

- 1980: Strikes in Poland

- 1982: First Lebanon War

- 1982: Sabra and Chatila

- 1986: Chernobyl disaster

- 1987-93: First Intifada

- 1989: Fall of the Berlin Wall

- 1979-90: Thatcher Government

- 1982: Falklands War

- 1983: Foundation of IBRP

- 1984-85: UK Miners' Strike

- 1987: Perestroika

- 1989: Tiananmen Square Protests

- 1990s

- 1991: Breakup of Yugoslavia

- 1991: Dissolution of Soviet Union

- 1991: First Gulf War

- 1992-95: UN intervention in Somalia

- 1994-96: First Chechen War

- 1994: Genocide in Rwanda

- 1999-2000: Second Chechen War

- 1999: Introduction of euro

- 1999: Kosovo War

- 1999: WTO conference in Seattle

- 1995: NATO Bombing in Bosnia

- 2000s

- 2000: Second intifada

- 2001: September 11 attacks

- 2001: Piqueteros Movement in Argentina

- 2001: War in Afghanistan

- 2001: G8 Summit in Genoa

- 2003: Second Gulf War

- 2004: Asian Tsunami

- 2004: Madrid train bombings

- 2005: Banlieue riots in France

- 2005: Hurricane Katrina

- 2005: London bombings

- 2006: Anti-CPE movement in France

- 2006: Comuna de Oaxaca

- 2006: Second Lebanon War

- 2007: Subprime Crisis

- 2008: Onda movement in Italy

- 2008: War in Georgia

- 2008: Riots in Greece

- 2008: Pomigliano Struggle

- 2008: Global Crisis

- 2008: Automotive Crisis

- 2009: Post-election crisis in Iran

- 2009: Israel-Gaza conflict

- 2020s

- 1920s

- 1921-28: New Economic Policy

- 1921: Communist Party of Italy

- 1921: Kronstadt Rebellion

- 1922-45: Fascism

- 1922-52: Stalin is General Secretary of PCUS

- 1925-27: Canton and Shanghai revolt

- 1925: Comitato d'Intesa

- 1926: General strike in Britain

- 1926: Lyons Congress of PCd’I

- 1927: Vienna revolt

- 1928: First five-year plan

- 1928: Left Fraction of the PCd'I

- 1929: Great Depression

- 1950s

- 1970s

- 1969-80: Anni di piombo in Italy

- 1971: End of the Bretton Woods System

- 1971: Microprocessor

- 1973: Pinochet's military junta in Chile

- 1975: Toyotism (just-in-time)

- 1977-81: International Conferences Convoked by PCInt

- 1977: '77 movement

- 1978: Economic Reforms in China

- 1978: Islamic Revolution in Iran

- 1978: South Lebanon conflict

- 2010s

- 2010: Greek debt crisis

- 2011: War in Libya

- 2011: Indignados and Occupy movements

- 2011: Sovereign debt crisis

- 2011: Tsunami and Nuclear Disaster in Japan

- 2011: Uprising in Maghreb

- 2014: Euromaidan

- 2016: Brexit Referendum

- 2017: Catalan Referendum

- 2019: Maquiladoras Struggle

- 2010: Student Protests in UK and Italy

- 2011: War in Syria

- 2013: Black Lives Matter Movement

- 2014: Military Intervention Against ISIS

- 2015: Refugee Crisis

- 2018: Haft Tappeh Struggle

- 2018: Climate Movement

People

- Amadeo Bordiga

- Anton Pannekoek

- Antonio Gramsci

- Arrigo Cervetto

- Bruno Fortichiari

- Bruno Maffi

- Celso Beltrami

- Davide Casartelli

- Errico Malatesta

- Fabio Damen

- Fausto Atti

- Franco Migliaccio

- Franz Mehring

- Friedrich Engels

- Giorgio Paolucci

- Guido Torricelli

- Heinz Langerhans

- Helmut Wagner

- Henryk Grossmann

- Karl Korsch

- Karl Liebknecht

- Karl Marx

- Leon Trotsky

- Lorenzo Procopio

- Mario Acquaviva

- Mauro jr. Stefanini

- Michail Bakunin

- Onorato Damen

- Ottorino Perrone (Vercesi)

- Paul Mattick

- Rosa Luxemburg

- Vladimir Lenin

Politics

- Anarchism

- Anti-Americanism

- Anti-Globalization Movement

- Antifascism and United Front

- Antiracism

- Armed Struggle

- Autonomism and Workerism

- Base Unionism

- Bordigism

- Communist Left Inspired

- Cooperativism and autogestion

- DeLeonism

- Environmentalism

- Fascism

- Feminism

- German-Dutch Communist Left

- Gramscism

- ICC and French Communist Left

- Islamism

- Italian Communist Left

- Leninism

- Liberism

- Luxemburgism

- Maoism

- Marxism

- National Liberation Movements

- Nationalism

- No War But The Class War

- PCInt-ICT

- Pacifism

- Parliamentary Center-Right

- Parliamentary Left and Reformism

- Peasant movement

- Revolutionary Unionism

- Russian Communist Left

- Situationism

- Stalinism

- Statism and Keynesism

- Student Movement

- Titoism

- Trotskyism

- Unionism

Regions

User login

This work is licensed under a Creative Commons Attribution 3.0 Unported License.