You are here

Home ›Capitalism is a State-sponsored Ponzi Scheme

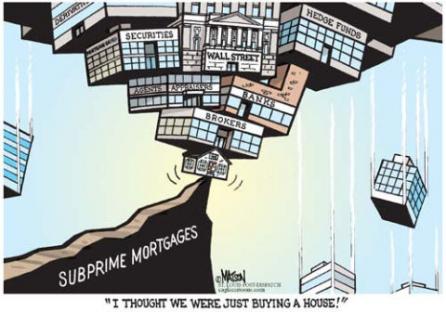

Is the economic crisis over? Many capitalists think it is. World stock markets have been rising, some banks are trying to pay parts of their government bailouts back and investment banks are now claiming they are making a profit again. The economic pundits of capitalism are so relieved that they are now arguing whether the international bail out was necessary in the first place. Complacency has returned and the bankers are once again demanding that they be left to regulate themselves. What these fans of the free market have so quickly forgotten is that “it was the state wot done it”. When Brown made his parliamentary gaffe of announcing that he and his fellow leaders “had saved the world” he was actually closer to the truth than he has been on many other issues. Without the massive state intervention we would have seen the unwinding of the entire global banking system, which would then have had an impact on the world economy much greater than it currently has. As it is there are still $760,000 billion credit derivative contracts outstanding (Financial Times 05-06-2009) and the full scale of corporate debt is as yet unknown. And unemployment is rising everywhere despite attempts by states to save local car manufacturing jobs (see page 7 in this issue). Without the use of the state as the lender of last resort the economic, and more especially social, turmoil would have been incalculable. But our ruling classes have learned from the past and they knew that there was, as Thatcher once said “no alternative”.

As our article on page 3 shows, the latest shenanigans in Westminster confirm that the capitalist state is politically and morally bankrupt, but what if it were seen to be economically bankrupt too? States are regarded as safe since governments cannot go bankrupt (well Mexico and Argentina can default but “real states” can’t). Or can they? The US now faces a budget deficit of 13% of GDP and its unfunded liabilities are now four times GDP. Its latest attempt to raise money on the financial markets almost went the way of Latvia’s until it offered 3.5% on long dated bonds to investors. The dollar (which revived under the first enthusiasm for the state programme of taking on bad debt) has now fallen 10% again in three months since February. Some commentators now refer to it as “the American peso” and the Chinese state which holds rather large amounts of dollars has repeatedly called for the US Government to support the dollar. The only thing left which allows the dollar to hold its special place at the centre of the world economy is the lack of a serious rival. And the US is not alone. Japan has had the biggest fall in growth rates of all the leading industrial countries, whilst Ireland and Spain have joined Latvia, Estonia and Bulgaria as suitable cases for scrutiny by the IMF. Ireland’s sovereign debt has been downgraded twice in the last three months and Standard and Poor have warned that the UK is next.

The US has in fact one of the highest levels of debt ratios to GDP in its history. According to one study this amounts to 30% of GDP compared with 39% for the total of all the economic stimuli applied in the previous 12 US downturns since 1929 (FT 01-06-2009). And the character of this stimulus is not to kickstart productive activity but simply to engineer a soft landing to a speculative boom - which has its roots thirty or more years ago in the end of the post-war boom. “Quantative easing” or the printing of money, the expansion of non-productive credit are all about postponing the day of reckoning. Capitalism has become like a Ponzi scheme directed by states’ creating funny money in order to hide the lack of real economic activity. As Edward Chancellor put it in the same Financial Times

Public policy today serves to delay the day of reckoning rather than promote a return to economic equilibrium.

And when that day of reckoning comes around the challenge for the working class and its revolutionary minorities will be to fight for socialism. We have already seen in Gaza and Sri Lanka, and elsewhere, a big enough glimpse of the barbaric alternative which capitalism will ultimately inflict on us all.

Revolutionary Perspectives

Journal of the Communist Workers’ Organisation -- Why not subscribe to get the articles whilst they are still current and help the struggle for a society free from exploitation, war and misery? Joint subscriptions to Revolutionary Perspectives (3 issues) and Aurora (our agitational bulletin - 4 issues) are £15 in the UK, €24 in Europe and $30 in the rest of the World.

Revolutionary Perspectives #50

Summer 2009 (Series 3)

Start here...

- Navigating the Basics

- Platform

- For Communism

- Introduction to Our History

- CWO Social Media

- IWG Social Media

- Klasbatalo Social Media

- Italian Communist Left

- Russian Communist Left

The Internationalist Communist Tendency consists of (unsurprisingly!) not-for-profit organisations. We have no so-called “professional revolutionaries”, nor paid officials. Our sole funding comes from the subscriptions and donations of members and supporters. Anyone wishing to donate can now do so safely using the Paypal buttons below.

ICT publications are not copyrighted and we only ask that those who reproduce them acknowledge the original source (author and website leftcom.org). Purchasing any of the publications listed (see catalogue) can be done in two ways:

- By emailing us at uk@leftcom.org, us@leftcom.org or ca@leftcom.org and asking for our banking details

- By donating the cost of the publications required via Paypal using the “Donate” buttons

The CWO also offers subscriptions to Revolutionary Perspectives (3 issues) and Aurora (at least 4 issues):

- UK £15 (€18)

- Europe £20 (€24)

- World £25 (€30, $30)

Take out a supporter’s sub by adding £10 (€12) to each sum. This will give you priority mailings of Aurora and other free pamphlets as they are produced.

ICT sections

Basics

- Bourgeois revolution

- Competition and monopoly

- Core and peripheral countries

- Crisis

- Decadence

- Democracy and dictatorship

- Exploitation and accumulation

- Factory and territory groups

- Financialization

- Globalization

- Historical materialism

- Imperialism

- Our Intervention

- Party and class

- Proletarian revolution

- Seigniorage

- Social classes

- Socialism and communism

- State

- State capitalism

- War economics

Facts

- Activities

- Arms

- Automotive industry

- Books, art and culture

- Commerce

- Communications

- Conflicts

- Contracts and wages

- Corporate trends

- Criminal activities

- Disasters

- Discriminations

- Discussions

- Drugs and dependencies

- Economic policies

- Education and youth

- Elections and polls

- Energy, oil and fuels

- Environment and resources

- Financial market

- Food

- Health and social assistance

- Housing

- Information and media

- International relations

- Law

- Migrations

- Pensions and benefits

- Philosophy and religion

- Repression and control

- Science and technics

- Social unrest

- Terrorist outrages

- Transports

- Unemployment and precarity

- Workers' conditions and struggles

History

- 01. Prehistory

- 02. Ancient History

- 03. Middle Ages

- 04. Modern History

- 1800: Industrial Revolution

- 1900s

- 1910s

- 1911-12: Turko-Italian War for Libya

- 1912: Intransigent Revolutionary Fraction of the PSI

- 1912: Republic of China

- 1913: Fordism (assembly line)

- 1914-18: World War I

- 1917: Russian Revolution

- 1918: Abstentionist Communist Fraction of the PSI

- 1918: German Revolution

- 1919-20: Biennio Rosso in Italy

- 1919-43: Third International

- 1919: Hungarian Revolution

- 1930s

- 1931: Japan occupies Manchuria

- 1933-43: New Deal

- 1933-45: Nazism

- 1934: Long March of Chinese communists

- 1934: Miners' uprising in Asturias

- 1934: Workers' uprising in "Red Vienna"

- 1935-36: Italian Army Invades Ethiopia

- 1936-38: Great Purge

- 1936-39: Spanish Civil War

- 1937: International Bureau of Fractions of the Communist Left

- 1938: Fourth International

- 1940s

- 1960s

- 1980s

- 1979-89: Soviet war in Afghanistan

- 1980-88: Iran-Iraq War

- 1980: Strikes in Poland

- 1982: First Lebanon War

- 1982: Sabra and Chatila

- 1986: Chernobyl disaster

- 1987-93: First Intifada

- 1989: Fall of the Berlin Wall

- 1979-90: Thatcher Government

- 1982: Falklands War

- 1983: Foundation of IBRP

- 1984-85: UK Miners' Strike

- 1987: Perestroika

- 1989: Tiananmen Square Protests

- 1990s

- 1991: Breakup of Yugoslavia

- 1991: Dissolution of Soviet Union

- 1991: First Gulf War

- 1992-95: UN intervention in Somalia

- 1994-96: First Chechen War

- 1994: Genocide in Rwanda

- 1999-2000: Second Chechen War

- 1999: Introduction of euro

- 1999: Kosovo War

- 1999: WTO conference in Seattle

- 1995: NATO Bombing in Bosnia

- 2000s

- 2000: Second intifada

- 2001: September 11 attacks

- 2001: Piqueteros Movement in Argentina

- 2001: War in Afghanistan

- 2001: G8 Summit in Genoa

- 2003: Second Gulf War

- 2004: Asian Tsunami

- 2004: Madrid train bombings

- 2005: Banlieue riots in France

- 2005: Hurricane Katrina

- 2005: London bombings

- 2006: Anti-CPE movement in France

- 2006: Comuna de Oaxaca

- 2006: Second Lebanon War

- 2007: Subprime Crisis

- 2008: Onda movement in Italy

- 2008: War in Georgia

- 2008: Riots in Greece

- 2008: Pomigliano Struggle

- 2008: Global Crisis

- 2008: Automotive Crisis

- 2009: Post-election crisis in Iran

- 2009: Israel-Gaza conflict

- 2020s

- 1920s

- 1921-28: New Economic Policy

- 1921: Communist Party of Italy

- 1921: Kronstadt Rebellion

- 1922-45: Fascism

- 1922-52: Stalin is General Secretary of PCUS

- 1925-27: Canton and Shanghai revolt

- 1925: Comitato d'Intesa

- 1926: General strike in Britain

- 1926: Lyons Congress of PCd’I

- 1927: Vienna revolt

- 1928: First five-year plan

- 1928: Left Fraction of the PCd'I

- 1929: Great Depression

- 1950s

- 1970s

- 1969-80: Anni di piombo in Italy

- 1971: End of the Bretton Woods System

- 1971: Microprocessor

- 1973: Pinochet's military junta in Chile

- 1975: Toyotism (just-in-time)

- 1977-81: International Conferences Convoked by PCInt

- 1977: '77 movement

- 1978: Economic Reforms in China

- 1978: Islamic Revolution in Iran

- 1978: South Lebanon conflict

- 2010s

- 2010: Greek debt crisis

- 2011: War in Libya

- 2011: Indignados and Occupy movements

- 2011: Sovereign debt crisis

- 2011: Tsunami and Nuclear Disaster in Japan

- 2011: Uprising in Maghreb

- 2014: Euromaidan

- 2016: Brexit Referendum

- 2017: Catalan Referendum

- 2019: Maquiladoras Struggle

- 2010: Student Protests in UK and Italy

- 2011: War in Syria

- 2013: Black Lives Matter Movement

- 2014: Military Intervention Against ISIS

- 2015: Refugee Crisis

- 2018: Haft Tappeh Struggle

- 2018: Climate Movement

People

- Amadeo Bordiga

- Anton Pannekoek

- Antonio Gramsci

- Arrigo Cervetto

- Bruno Fortichiari

- Bruno Maffi

- Celso Beltrami

- Davide Casartelli

- Errico Malatesta

- Fabio Damen

- Fausto Atti

- Franco Migliaccio

- Franz Mehring

- Friedrich Engels

- Giorgio Paolucci

- Guido Torricelli

- Heinz Langerhans

- Helmut Wagner

- Henryk Grossmann

- Karl Korsch

- Karl Liebknecht

- Karl Marx

- Leon Trotsky

- Lorenzo Procopio

- Mario Acquaviva

- Mauro jr. Stefanini

- Michail Bakunin

- Onorato Damen

- Ottorino Perrone (Vercesi)

- Paul Mattick

- Rosa Luxemburg

- Vladimir Lenin

Politics

- Anarchism

- Anti-Americanism

- Anti-Globalization Movement

- Antifascism and United Front

- Antiracism

- Armed Struggle

- Autonomism and Workerism

- Base Unionism

- Bordigism

- Communist Left Inspired

- Cooperativism and autogestion

- DeLeonism

- Environmentalism

- Fascism

- Feminism

- German-Dutch Communist Left

- Gramscism

- ICC and French Communist Left

- Islamism

- Italian Communist Left

- Leninism

- Liberism

- Luxemburgism

- Maoism

- Marxism

- National Liberation Movements

- Nationalism

- No War But The Class War

- PCInt-ICT

- Pacifism

- Parliamentary Center-Right

- Parliamentary Left and Reformism

- Peasant movement

- Revolutionary Unionism

- Russian Communist Left

- Situationism

- Stalinism

- Statism and Keynesism

- Student Movement

- Titoism

- Trotskyism

- Unionism

Regions

User login

This work is licensed under a Creative Commons Attribution 3.0 Unported License.