You are here

Home ›1971-2021: 50 Years Since the USA Reneged on Bretton Woods

For the CWO, and indeed the entire political tendency to which we belong, it is axiomatic that we are living through capitalism’s third global economic crisis. For over a century the economic system (mode of production) which was once progressive for humanity, in that it created the material possibility of a prosperous world community without national borders or class divisions, has represented a barrier to human progress when it is not a direct threat to human existence itself.

The key, of course, is that having created a world economy, the laws of motion of capitalism mean that by the turn of the twentieth century,

the process of capital concentration and centralisation [had] reached such proportions that henceforward the cyclical crises which had always been an intrinsic part of the process of capital accumulation would be global crises, resolvable only by world war.

Platform of the Internationalist Communist Tendency

Capitalism’s fundamental law of motion is the drive for profit, or rather to increase the rate of profit by continually reducing the cost of production of individual commodities whilst vastly increasing output per worker. Nowadays ‘capitalism’ and the ‘profit motive’ are coming under attack from various kinds of reformists (notably environmentalists shocked by capitalism’s plunder of the planet and destruction of the natural world, and would-be social reformers, outraged by the growing ‘wealth gap’ in a world burgeoning with consumer commodities). What they inevitably overlook is not just that capitalism is ‘unfair’, but that the fundamental injustice, which is at the heart of this mode of production, is the appropriation by capital of the new value (wealth, if you like) created by the working class over and above the value of their wages. This is all the more dramatic as capitalism’s constant scientific and technological innovations (since the industrial revolution, for example) have entailed a stupendous increase in productivity, i.e. the amount of new value created by the average wage worker in a given period of time. Yet this is not reflected in the number of hours worked. (Since 1870 only a very few long-established first world economies, such as Germany, the UK, France, have even managed to halve the average number of hours worked per year.(1))

Yet historically this fundamentally unjust system, which has no other dynamic than to ‘maximise profit’, served to create a global economy with the means to potentially allow the whole of humankind to participate in the creation of a world community of “freely associated producers”.

However this constant “tearing down (of) all the barriers which hem in the development of the forces of production” (Marx, Grundrisse) never has been a linear development. Capitalism has always been subject to booms and busts: regular crises leading to wage cuts and unemployment for the workforce; write-offs, take-overs and eventually a renewed cycle of accumulation for capital on a more concentrated, centralised, higher technological basis which brought increased productivity rates (otherwise understood as rate of exploitation) but a generally lower rate of profit. This tendency for the general rate of profit to decline,

… is in every respect the most important law of modern political economy, and the most essential for understanding the most difficult relations. It is the most important law from the historical standpoint.(2)

Marx, Grundrisse

Why? Because it is both the reason for its continual expansion and the cause of recurring crises during which capital is devalued, becomes more concentrated and centralised, and in so doing prepares the way for a new round of accumulation. Historically this meant development from individual entrepreneurs clawing back profit on a single enterprise, to joint stock companies, stock exchanges and, on the European continent especially, the development of finance capital. In terms of the cyclical crisis it meant an increasing synchronisation, first between sectors within domestic economies then throughout the capitalist world. By the end of the nineteenth century it meant the growth of big business, pools, cartels, mergers and monopolies at home and the massive export of capital abroad, as the drive to offset the tendency for the rate of profit to fall, accelerated the search for more profitable investment outlets overseas. Thus a world economy came into being, and the battle for new markets and investments, for cheap sources of raw materials, became more than straightforward economic competition and turned into what was termed ‘the new imperialism’ — against a background of a long, drawn-out series of international economic crises, once labelled the Great Depression (1873-96). Like today, the period before the First World War saw a dramatic increase in foreign trade but also growing signs of capitalism’s movement away from laissez-faire to more direct involvement of the state in protecting the domestic economy. This could be seen in the return to tariff barriers by England and France in the depressions of 1873, 1882, 1890 and 1907. Marx, who died in 1883, did not predict the First World War. (Although Engels, who died in 1896, did.) But Marx did foresee that that capitalism would outgrow the stage of free competition.

As long as capital is weak, it still relies on the crutches of past modes of production, or those that will pass with its rise. As soon as it feels strong, it throws away the crutches, and moves in accordance with its own laws. As soon as it begins to sense itself as a barrier to development, it seeks refuge in forms which, by restricting free competition, seem to make the rule of capital more perfect, but are at the same time the heralds of its dissolution and of the dissolution of the mode of production resting on it.

ibid., p. 651

But it was for the next generation of revolutionary Marxists, confronted by the ‘new imperialism’, and then by world war itself, to explain the changed reality of capitalism. Bukharin and Lenin (unlike Kautsky) saw that the imperialist war was not an aberrant interruption to the normal course of capital accumulation, but an intrinsic part of it, since capital had become so centralised and concentrated that the purely economic competition had given way to competition between states, whose interests were inextricably bound up with the interests of monopolies and finance capital. For Bukharin laissez-faire had given way to state capitalism. Lenin used the term ‘monopoly capitalism’ or ‘state monopoly capitalism’ (in State and Revolution). It was Lenin too who spelled out clearly that with imperialism capitalism had entered a new historical epoch of decay as a mode of production (although adding that “It would be a mistake to believe that this tendency to decay precludes the possibility of the rapid growth of capitalism ...”). It is this understanding of the historically decadent nature of capitalism that underpinned the formation of the Third International, whose founding Congress announced that the present epoch is one of wars and revolutions. It is in keeping with Marx’s own vision of how the inner contradictions of the system, which was developing the material basis for communism, would eventually become a barrier to the birth of that new society.

Here is Marx again in the Grundrisse, on the falling rate of profit:

The growing incompatibility between the productive development of society and its hitherto existing relations of production expresses itself in bitter contradictions, crises, spasms. The violent destruction of capital not by relations external to it, but rather as a condition of its self-preservation, is the most striking form in which advice is given to it to be gone, and to make way for a higher state of social production. Hence the highest development of productive power together with the greatest expansion of existing wealth will coincide with depreciation of capital, degradation of the labourer and a most straitened exhaustion of his vital powers. These contradictions lead to explosions, cataclysms, crises in which by momentous suspension of labour and annihilation of a great portion of capital the latter is violently reduced to the point where it can go on. … Yet these regularly recurring catastrophes lead to their repetition on a higher scale and finally to its violent overthrow.

ibid., p.750

In the 20th century, two world wars (and one defeated working class revolution) were the outcome of the cyclical capitalist crisis writ large. Having annihilated “a great portion of capital” the Second World War provided the basis for the longest capitalist boom and, what has turned out to be, an even longer economic crisis in capitalism’s history to date.

Bretton Woods

Even before the war in Europe was over, before the Allies had finished bombing German cities to pulp and the USA had dropped the atomic bomb on Hiroshima, negotiations were underway to define the post-war new world order. It was to be a world divided between two very unequal imperialist blocs: the USSR and its Eastern European satellites on the one hand and the USA with its Western European associates, eventually suitably stripped of their colonies, on the other. And even before the political deal for this re-division of the world was made at Yalta in February 1945 (by Roosevelt, Churchill and Stalin), a hotel in the US mountain resort of Bretton Woods in New Hampshire became the venue for the USA and the ‘Allies’ to wrangle over the economic basis and terms of trade for the new world order. (July, 1944) Reams have been written on the wrestling between the negotiator for severely beaten British imperialism, John Maynard Keynes, with his proposition for the creation of an independent currency for international trade (the ‘bancor’) and the USA negotiator, Harry Dexter White, whose counter-proposal that the US dollar should become the currency of international trade was inevitably accepted. (Especially as it was accompanied by the threat to cut off any further US credits for the Allied ‘war effort’.(3)) The USA was now imperialist top dog and it was the dollar that would be the new yardstick for international trade. In the new world order member states would peg their currencies to the US dollar, and to ensure no return to the beggar my neighbour currency devaluations of the inter-war years, the USA would peg the dollar to gold, at a price of $35 per ounce. Part and parcel of the arrangement was the setting up of the World Bank, charged with acting as creditor to the IMF with transactions inevitably in dollars. The one big rider to this is that Russia did not ratify the final agreements and in 1947, at the UN General Assembly, denounced the Bretton Woods institutions as “branches of Wall Street” and the World Bank as “subordinated to political purposes which make it the instrument of one great power”.(4)

The Russian delegate, Andrei Gromyko, was not wrong. However, his opposition to the final Bretton Woods settlement was by no means opposition to an imperialist carve-up. It was simply resistance to US domination on the part of a weaker imperialism. Weaker, but nevertheless with its territory spanning most of Europe and a huge part of Asia, the USSR (so-called ‘Union of Soviet Socialist Republics’) was trying to secure its own satellites and escape from hegemony of the dollar. By this point Churchill had delivered his Iron Curtain speech,(5) and Truman had announced his ‘doctrine’ that the USA would support any ‘democratic nation’ under threat from authoritarian forces. In 1947 the USA began to implement the Marshall Plan for its allies in Europe. Essentially this meant financial aid to countries the USA perceived as under threat from:

Communist movements … directed by Moscow, (which) feed on economic and political weakness. The countries under Communist pressure require economic assistance on a large scale if they are to maintain their territorial integrity and political independence. At one time it had been expected that the International Bank could satisfy the needs for such assistance. But it is now clear that the bank cannot do this job. The United States is faced with a world-wide challenge to human freedom. The only way to meet this challenge is by a vast new programme of assistance given directly by the United States itself.(6)

In response the Soviet Union formed the Council for Mutual Economic Assistance (Comecon) in 1949, in part to discourage countries in Eastern Europe from participating in the Marshall Plan and to counteract trade boycotts imposed by the USA and by Britain and other Western European countries.

Meanwhile the war had left the UK bankrupt, and in hock to the USA, a fact emphasised by the terms of the loan Keynes was sent to negotiate with the US (and Canada) in 1946. Above all, the stipulation that countries with trade balances in sterling would be allowed to convert them into dollars from July 1947, led to a run on British dollar reserves. Convertibility was suspended, but by 1949 a more realistic exchange rate was established when sterling was devalued from $4.03 to $2.80.(7) In fact, the situation facing sterling was only a more dire version of what faced many states. By the end of September more countries, including Australia, Canada, Finland, France, India, Ireland, Israel, New Zealand, Norway and Sweden, followed the UK and devalued their currencies against the dollar. The immediate threat to capitalism in the West was not from ‘communism’ spreading from Russia but from the dearth and destitution facing the working class of its bankrupt allies turning into something more politically dangerous than inconvenient strikes and protests. And not only US allies. From November 1945, through 1946, the biggest strike wave in the history of the USA, fuelled by a rapid rise in inflation and involving more than 5 million workers, largely outside of the trade unions, occurred. The challenge for US capital was to find a way to improve the situation of the working class by reviving both its own domestic economy, and the economies of its allies. Marshall Aid, which transferred approximately $13 billion to Western Europe between 1948 and 1952 was as much about countering the threat from within as from communist movements “directed by Moscow”.

The scene was set for a bi-polar imperialist division of the world, the Cold War and the biggest boom in history.

The Long Boom

With up to 50% of world manufacturing inside the USA,(8) and the dollar as the prime currency of international exchange, US capitalism was in prime position to lead a new cycle of capital accumulation. In 1960, with its balance of trade in surplus, the GDP of the USA accounted for 40% of total world output. It was a boom in which its allies soon caught up — thanks in part to the US running a budget deficit to finance the Korean war (which gave a boost to West German exports in particular), and the regeneration of Japan. It’s worth reminding readers today how much that upsurge in production, born out of the destruction of world war which allowed for a new round of capital accumulation, changed working class lives. So often defined as a ‘consumer boom’, this boom was predicated on the expansion of state welfare measures planned during the war and designed to undermine any inclination for workers to be attracted to ‘communism’ (read Stalinism) and essentially paid for by money taken out of workers’ wage packets before they opened them. For the first time hospital and health care were available for all (in the UK the famous NHS) while national sick pay, unemployment benefit entitlements and viable old age pension schemes put an end to the workhouse in Britain and generally ensured that workers did not have to carry on working until they dropped. Meanwhile, working class children were now entitled to secondary education and a small minority began to enter the ivory towers of university academia (subject to a means-tested grant for a living allowance), giving rise to theories about the ‘rise of the meritocracy’.

The early post-war decades were a time of very low unemployment (the capitalists called it full employment) and rising real wages, which enabled workers to purchase an increasing variety of consumer goods, as well as state house (and high rise) building programmes which created new towns and reduced, but never quite eliminated, the shortage of housing. In the UK rationing was phased out by 1954 and as early as 1957 Prime Minister Harold Macmillan could pronounce that “you’ve never had it so good!”

In tandem with the US, building new road networks and expansion of the car industry were prioritised over railways, especially in the UK where the (unprofitable) railway network that had linked up the whole of Britain was slashed to make way for the expansion of the car industry. The Sixties proved a boom time for the car industry, with the number of private cars doubling from almost 5 million to nearly 10 million in the decade between 1961 and 1971. Moreover, car or no car, with many firms implementing a summer shutdown with holiday pay, tourist firms expanded to create a mass market in ‘package holidays’: in the transition from Butlins to Benidorm many working class families travelled abroad for the first time.

More generally, the expansion of the market in consumer goods led to the proverbial boom in production of ‘labour-saving devices’ from vacuum cleaners to washing machines, which reduced the time ‘housewives’ needed to stay at home. The unintended consequence, in a period of ‘full employment’, was that more and more women ‘entered the labour market’. Unlike previous periods of increased female employment (usually wartime) this has proved to be a permanent trend, reflecting the domination of services in the capitalist economy as well as the practical possibilities opened up by the general availability of female-controlled contraception by the end of the Sixties.

This is an overview of how the capitalist boom affected the working class in Britain but it was essentially the same for workers in the Western capitalist bloc. In France, the boom years are referred to as Les Trente Glorieuses (1945-75), in Italy as Il Sorpasso (the decades which went beyond all others); in the USA, workers were assured they were living the American Dream. After being told we had never had it so good, Britain headed into the Swinging Sixties and the working class embarked on a decade or so of official and unofficial strikes. From 1963-7 2-3 millions of working days were ‘lost’ each year, culminating in 4.7 million in 1968. However, this robust workers’ militancy never really went beyond the horizon of the workplace. When boom turned to bust the working class had no vision of an alternative to capitalism.

US Reneges on Bretton Woods: Beginning of the Prolonged Bust

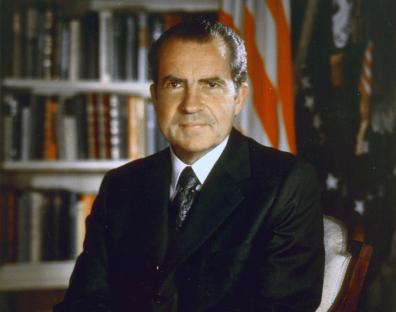

On 15 August 1971, President Richard Nixon unilaterally announced the “temporary” cancellation of the mainstay of the Bretton Woods agreement: the system of fixed exchange rates based on the direct convertibility of the US dollar to gold. In effect the dollar was the unit of international trade. As trade picked up and countries like West Germany and Japan began to account for a bigger share of international trade, demand for dollars outside the USA grew, as did financial wheeling and dealing on the Euro dollar market. By the early Sixties there were more dollars outside the USA than could be covered by the gold in Fort Knox. As inflation edged up towards the end of the Sixties more and more of those dollars were being converted to gold, increasingly not at the official rate of $35 per ounce. The system was unsustainable. The USA was already running a growing budget deficit, largely due to expenditure on the Vietnam war. But in 1971 the US balance of trade showed negative for the first time since the war. The ‘Nixon Shock’ spelled the beginning of the end of the Bretton Woods economic frame for the world economy. By the time Nixon confirmed the permanent end to a fixed exchange rate with gold in 1973 the price of gold had reached $100 per ounce. The equivalent price today is around $1,900. Clearly there can be no going back.

The de-linking of the dollar from gold not only allowed the US Treasury to ‘print’ dollars at will, it was effectively a devaluation of the currency which rebounded on the price of commodities traded mainly in dollars on the world market, notably oil. This not only upped the cost of raw materials for competing Japanese and European (largely West German) manufacturers, it sparked continual price increases throughout the Western world for typical working class consumer goods. During the Seventies the UK had some of the highest annual inflation rates in Western Europe. The prime architect of the ‘Nixon Shock’ was Treasury Secretary John Connally whose infamous quip (at the G10 meeting in Rome) that the “dollar is our currency but your problem” had not prevented him from imposing a 10% surcharge on imports into the US, and a 90-day wage and price freeze for workers in the USA. Indeed the working class in the USA found themselves in the same boat as workers elsewhere in the world’s ‘advanced countries’ and beyond. According to the OECD workers’ share of national income in the G20 declined steadily between 1970 and 2014, with the working class in the USA experiencing the fourth largest drop of around 11%. This is now a worldwide trend which includes so-called emerging economies. (Today workers’ share of total global output is estimated to be around 50%.)

The USA’s abrogation of a key part of the Bretton Woods agreement it had carved out in its own interests ushered in a long, downward stage in the third cycle of global capitalist accumulation. Over the last five decades we have seen the collapse of the USSR and the post-war imperialist carve-up agreed at Yalta while the USA, now barely accounting for a fifth of global GDP, is struggling to maintain its domination. So far it has managed to retain its top dog position, largely thanks to the dollar’s role as the predominant unit of international finance and trade — something it could not have done if the dollar’s link to gold had been retained. When a certain Saddam Hussein threatened to trade Iraqi oil in other currencies rather than dollars, the USA showed it is prepared to defend its own economic interest with direct military might by invading Iraq for a second time in 2003. For a brief spell capitalist pundits were telling us about the uncontested hegemony of the US. That narrative ended after Chinese capitalism stepped in to keep up demand and international trade during the global recession which followed the bursting of capitalism’s biggest-ever financial bubble (the so-called sub-prime crisis) in 2007-8.(9)

Today everyone knows that China is challenging the US. But what’s important for the world working class is to recognise that these two rivals are part and parcel of the same capitalist system, facing the same crisis of profitability which is making it harder and harder to find profitable place to invest, and driving capitalism throughout the world to find ways and means of upping the rate of exploitation: the amount of new value created over and above the cost of wages and the general upkeep of the labour force. In other words, after five decades of capitalist crisis there is no going back to the Swinging Sixties for the working class. And why indeed would we want to when the alternative of getting rid of decaying capitalism and replacing it with a world society of freely associated producers is staring us in the face?

ERayner

Notes

(1) See ourworldindata.org, incidentally a useful website (although openly advancing liberal optimism regarding the future of the capitalist economy) which encourages its data to be used freely.

(2) Marx in the Grundrisse, Pelican ed. 1973, p.748

(3) See “Uncontested Hegemony: From Bretton Woods to the Gold Pool, 1945-60” in The World Economic Crisis, Fitt, Faire and Vigier, p.74-77.

(4) See Eric Toussaint, cadtm.org

(5) Delivered at Westminster College, Fulton, Missouri, 5.3.46 where he had rhetorically declared: “From Stettin in the Baltic to Trieste in the Adriatic, an iron curtain has descended across the continent.” Annotated facsimile available on the website of the National Archives.

(6) From a memorandum by Will Clayton, Assistant Secretary of State for Economic Affairs, on his return from Europe early in 1947, quoted in Brett, op.cit. pp.106-7.

(7) See for example, Benn Stein, The Battle of Bretton Woods, Princeton Press p.331

(8) Estimates diverge. E.A. Brett, in The World Economy Since the War (Macmillan) is a conservative “more than 40 per cent”, p.63.

(9) “During the agonizing 18-month recession, unemployment reached as high as 10 percent and GDP shrunk by a whopping 4.3 percent. The economy only turned around after massive government stimulus spending (more than $1.5 trillion) to prop up the failing banks and inject capital into the shell-shocked economy.” history.com In fact the crash was much more than a US one. The world economy was pushed into recession, with knock-on consequences including the Arab Spring, ‘austerity’ for the working class and a further decline in productive investment.

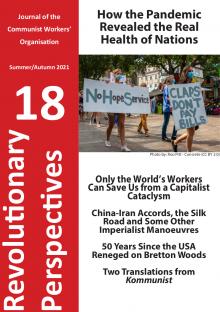

Revolutionary Perspectives

Journal of the Communist Workers’ Organisation -- Why not subscribe to get the articles whilst they are still current and help the struggle for a society free from exploitation, war and misery? Joint subscriptions to Revolutionary Perspectives (3 issues) and Aurora (our agitational bulletin - 4 issues) are £15 in the UK, €24 in Europe and $30 in the rest of the World.

Revolutionary Perspectives #18

Summer/Autumn 2021 (Series 4)

Start here...

- Navigating the Basics

- Platform

- For Communism

- Introduction to Our History

- CWO Social Media

- IWG Social Media

- Klasbatalo Social Media

- Italian Communist Left

- Russian Communist Left

The Internationalist Communist Tendency consists of (unsurprisingly!) not-for-profit organisations. We have no so-called “professional revolutionaries”, nor paid officials. Our sole funding comes from the subscriptions and donations of members and supporters. Anyone wishing to donate can now do so safely using the Paypal buttons below.

ICT publications are not copyrighted and we only ask that those who reproduce them acknowledge the original source (author and website leftcom.org). Purchasing any of the publications listed (see catalogue) can be done in two ways:

- By emailing us at uk@leftcom.org, us@leftcom.org or ca@leftcom.org and asking for our banking details

- By donating the cost of the publications required via Paypal using the “Donate” buttons

- By cheque made out to "Prometheus Publications" and sending it to the following address: CWO, BM CWO, London, WC1N 3XX

The CWO also offers subscriptions to Revolutionary Perspectives (3 issues) and Aurora (at least 4 issues):

- UK £15 (€18)

- Europe £20 (€24)

- World £25 (€30, $30)

Take out a supporter’s sub by adding £10 (€12) to each sum. This will give you priority mailings of Aurora and other free pamphlets as they are produced.

ICT sections

Basics

- Bourgeois revolution

- Competition and monopoly

- Core and peripheral countries

- Crisis

- Decadence

- Democracy and dictatorship

- Exploitation and accumulation

- Factory and territory groups

- Financialization

- Globalization

- Historical materialism

- Imperialism

- Our Intervention

- Party and class

- Proletarian revolution

- Seigniorage

- Social classes

- Socialism and communism

- State

- State capitalism

- War economics

Facts

- Activities

- Arms

- Automotive industry

- Books, art and culture

- Commerce

- Communications

- Conflicts

- Contracts and wages

- Corporate trends

- Criminal activities

- Disasters

- Discriminations

- Discussions

- Drugs and dependencies

- Economic policies

- Education and youth

- Elections and polls

- Energy, oil and fuels

- Environment and resources

- Financial market

- Food

- Health and social assistance

- Housing

- Information and media

- International relations

- Law

- Migrations

- Pensions and benefits

- Philosophy and religion

- Repression and control

- Science and technics

- Social unrest

- Terrorist outrages

- Transports

- Unemployment and precarity

- Workers' conditions and struggles

History

- 01. Prehistory

- 02. Ancient History

- 03. Middle Ages

- 04. Modern History

- 1800: Industrial Revolution

- 1900s

- 1910s

- 1911-12: Turko-Italian War for Libya

- 1912: Intransigent Revolutionary Fraction of the PSI

- 1912: Republic of China

- 1913: Fordism (assembly line)

- 1914-18: World War I

- 1917: Russian Revolution

- 1918: Abstentionist Communist Fraction of the PSI

- 1918: German Revolution

- 1919-20: Biennio Rosso in Italy

- 1919-43: Third International

- 1919: Hungarian Revolution

- 1930s

- 1931: Japan occupies Manchuria

- 1933-43: New Deal

- 1933-45: Nazism

- 1934: Long March of Chinese communists

- 1934: Miners' uprising in Asturias

- 1934: Workers' uprising in "Red Vienna"

- 1935-36: Italian Army Invades Ethiopia

- 1936-38: Great Purge

- 1936-39: Spanish Civil War

- 1937: International Bureau of Fractions of the Communist Left

- 1938: Fourth International

- 1940s

- 1960s

- 1980s

- 1979-89: Soviet war in Afghanistan

- 1980-88: Iran-Iraq War

- 1982: First Lebanon War

- 1982: Sabra and Chatila

- 1986: Chernobyl disaster

- 1987-93: First Intifada

- 1989: Fall of the Berlin Wall

- 1979-90: Thatcher Government

- 1980: Strikes in Poland

- 1982: Falklands War

- 1983: Foundation of IBRP

- 1984-85: UK Miners' Strike

- 1987: Perestroika

- 1989: Tiananmen Square Protests

- 1990s

- 1991: Breakup of Yugoslavia

- 1991: Dissolution of Soviet Union

- 1991: First Gulf War

- 1992-95: UN intervention in Somalia

- 1994-96: First Chechen War

- 1994: Genocide in Rwanda

- 1999-2000: Second Chechen War

- 1999: Introduction of euro

- 1999: Kosovo War

- 1999: WTO conference in Seattle

- 1995: NATO Bombing in Bosnia

- 2000s

- 2000: Second intifada

- 2001: September 11 attacks

- 2001: Piqueteros Movement in Argentina

- 2001: War in Afghanistan

- 2001: G8 Summit in Genoa

- 2003: Second Gulf War

- 2004: Asian Tsunami

- 2004: Madrid train bombings

- 2005: Banlieue riots in France

- 2005: Hurricane Katrina

- 2005: London bombings

- 2006: Comuna de Oaxaca

- 2006: Second Lebanon War

- 2007: Subprime Crisis

- 2008: Onda movement in Italy

- 2008: War in Georgia

- 2008: Riots in Greece

- 2008: Pomigliano Struggle

- 2008: Global Crisis

- 2008: Automotive Crisis

- 2009: Post-election crisis in Iran

- 2009: Israel-Gaza conflict

- 2006: Anti-CPE Movement in France

- 2020s

- 1920s

- 1921-28: New Economic Policy

- 1921: Communist Party of Italy

- 1921: Kronstadt Rebellion

- 1922-45: Fascism

- 1922-52: Stalin is General Secretary of PCUS

- 1925-27: Canton and Shanghai revolt

- 1925: Comitato d'Intesa

- 1926: General strike in Britain

- 1926: Lyons Congress of PCd’I

- 1927: Vienna revolt

- 1928: First five-year plan

- 1928: Left Fraction of the PCd'I

- 1929: Great Depression

- 1950s

- 1970s

- 1969-80: Anni di piombo in Italy

- 1971: End of the Bretton Woods System

- 1971: Microprocessor

- 1973: Pinochet's military junta in Chile

- 1975: Toyotism (just-in-time)

- 1977-81: International Conferences Convoked by PCInt

- 1977: '77 movement

- 1978: Economic Reforms in China

- 1978: Islamic Revolution in Iran

- 1978: South Lebanon conflict

- 2010s

- 2010: Greek debt crisis

- 2011: War in Libya

- 2011: Indignados and Occupy movements

- 2011: Sovereign debt crisis

- 2011: Tsunami and Nuclear Disaster in Japan

- 2011: Uprising in Maghreb

- 2014: Euromaidan

- 2016: Brexit Referendum

- 2017: Catalan Referendum

- 2019: Maquiladoras Struggle

- 2010: Student Protests in UK and Italy

- 2011: War in Syria

- 2013: Black Lives Matter Movement

- 2014: Military Intervention Against ISIS

- 2015: Refugee Crisis

- 2018: Haft Tappeh Struggle

- 2018: Climate Movement

People

- Amadeo Bordiga

- Anton Pannekoek

- Antonio Gramsci

- Arrigo Cervetto

- Bruno Fortichiari

- Bruno Maffi

- Celso Beltrami

- Davide Casartelli

- Errico Malatesta

- Fabio Damen

- Fausto Atti

- Franco Migliaccio

- Franz Mehring

- Friedrich Engels

- Giorgio Paolucci

- Guido Torricelli

- Heinz Langerhans

- Helmut Wagner

- Henryk Grossmann

- Karl Korsch

- Karl Liebknecht

- Karl Marx

- Leon Trotsky

- Lorenzo Procopio

- Mario Acquaviva

- Mauro jr. Stefanini

- Michail Bakunin

- Onorato Damen

- Ottorino Perrone (Vercesi)

- Paul Mattick

- Rosa Luxemburg

- Vladimir Lenin

Politics

- Anarchism

- Anti-Americanism

- Anti-Globalization Movement

- Antifascism and United Front

- Antiracism

- Armed Struggle

- Autonomism and Workerism

- Base Unionism

- Bordigism

- Communist Left Inspired

- Cooperativism and Autogestion

- DeLeonism

- Environmentalism

- Fascism

- Feminism

- German-Dutch Communist Left

- Gramscism

- ICC and French Communist Left

- Islamism

- Italian Communist Left

- Leninism

- Liberism

- Luxemburgism

- Maoism

- Marxism

- National Liberation Movements

- Nationalism

- No War But The Class War

- PCInt-ICT

- Pacifism

- Parliamentary Center-Right

- Parliamentary Left and Reformism

- Peasant movement

- Revolutionary Unionism

- Russian Communist Left

- Situationism

- Stalinism

- Statism and Keynesism

- Student Movement

- Titoism

- Trotskyism

- Unionism

Regions

User login

This work is licensed under a Creative Commons Attribution 3.0 Unported License.