You are here

Home ›Capitalism's Economic Foundations (Part II)

As explained in our previous issue, we have decided to re-issue a serialised and updated version of an article which appeared almost 50 years ago in only the second edition of the first series of Revolutionary Perspectives, when the group that was to become the CWO was setting out its Marxist political analysis. Apart from some additional commentary, mainly to address concerns by contemporary readers, most of the additions are in fact re-insertions of material from the original draft which had at the time been omitted to save space.

The Crisis-Driven Rise of Capitalism

What we have presented so far is the theoretical analysis Marx developed in the three volumes of Capital and elsewhere to understand the real laws of movement of the mode of production. Two decades before the first volume of Capital appeared, Marx could see that this rising mode of production had the potential to revolutionise the productive forces in a way never seen before. This is why he saw it as an advance on feudalism. However, he was under no illusion about the origins or the day to day horrors of capitalism. Primitive accumulation, which provided the capital to launch this revolution, was “anything but an idyll”.

In actual history, it is a notorious fact that conquest, enslavement, robbery, murder, in short, force, play the greatest part.(1)

Alongside the theft of common land which turned most of the peasantry into a “free” and “labouring poor”, capitalism could only burst out of Europe, via the spoliation of the rest of the planet.

The discovery of gold and silver in the Americas, the extirpation, enslavement and entombment in mines of the indigenous population of that continent, the beginning of the conquest and plunder of India and the conversion of Africa into a preserve for the hunting of black skins are all things which characterise the dawn of the era of capitalist production.(2)

Recent research suggests that “extirpation” via war, brutal exploitation and imported disease in the Americas killed 56 million people or 90% of the population by 1600.(3) Little wonder then that Marx concluded that “capital comes (into the world) dripping from head to toe, from every pore, with blood and dirt.”(4)

Whereas previous modes of production had crises due to a dearth of goods to satisfy basic needs, capitalism’s periodic crises were the product of what “would have seemed an absurdity” in earlier epochs, “the epidemic of overproduction”.(5)

It was only after the 1848 Communist Manifesto that Marx set out to explain why this was so, and in so doing discovered the law of the tendency of the rate of profit to fall which we described earlier. This not only explains why capitalism is such a dynamic mode of production but also why capital accumulation takes the form of booms followed by crises. Under classical capitalism, these were overcome by the devaluation of capital, increased concentration and centralisation and renewed accumulation with a higher organic composition, and hence with a lower general rate of profit which implies both an increase in tempo and an increase in intensity of crises. Thus the capitalist process of reproduction is not a mere circular process of devaluation and renewed accumulation, but rather is more accurately described in terms of a spiral which narrows until eventually no renewed accumulation is possible because, at a certain point, the organic composition reaches such a level, and the rate of profit is so low, that to reinvest in more constant capital would bring in less surplus value than with a lower organic composition. Thus,

The same laws which had at first constituted the motive forces of a rapid development of capitalism, now become the driving force of capitalist collapse.(6)

However, long before accumulation reaches its ultimate limits the process of concentration and centralisation of capital brings about significant changes in the mode of production. As wealth accumulates so too does excessive control of capital in few hands, or monopoly, which “becomes a fetter upon the mode of production which has flourished alongside and under it”.(7)

This is only another way of saying that up to a certain point in time the accumulation of capital was in the historical interests of humanity as a whole, in that the material pre-conditions for a higher mode of production were being developed. However, once capital had developed the productive forces on a world scale, then the material foundations for a higher form of production – production for human needs without commodity exchange – were now in existence; and although history has shown us that renewed accumulation and economic expansion can still occur, it has also shown us that such accumulation is in no sense in “the best interests of humanity”.

However this is to anticipate. In the nineteenth century the accumulation of capital was still a progressive force, involving the overthrow of the last remnants of feudal relations and a gradual improvement in the general standard of living. This expansion of the capitalist mode of production and the increase in mechanisation, which is associated with the growth in the organic composition of capital, consisted largely of the gradual elimination of cottage industries and small craftsmen who became more and more unable to compete with capitalist production techniques. For instance, in England there were still twice as many hand-looms as power-looms in operation in the cotton industry in 1834, but the hand-loom weavers’ increasing inability to compete led to their being completely driven out of the industry after the crisis of 1846-48, and replaced by factory production.

A similar picture of increasing capital accumulation resulting in increased output from the industrial sphere, but still within the context of a substantial handicraft production, could be drawn for other developing capitalist economies in Europe, as well as in North America, in the middle of the nineteenth century, although in 1850 capitalism was far from having established itself as the dominant mode of production on a world scale. However, by the mid-nineteenth century the basis for capitalism’s continued development of the productive forces, both nationally and internationally, was firmly established in the advanced capitalist countries. Small craftsmen were being eliminated; the gradual abolition of serfdom, coupled with a rising population and relatively low agricultural wages meant that capital had a continuous supply of wage labour to facilitate its expansion. Improvements in transport and communications, whilst shortening the period of capital turnover and thus providing a counter-tendency to the declining rate of profit (by reducing the period during which raw materials and finished goods were in transit and reducing the volume of stock necessary to be held in hand), at the same time provided the technical foundations for capital’s further expansion.

In spite of some state intervention in the economy in areas like railways which required a high initial outlay of capital, the tendency towards laissez-faire meant that private capitalists were responsible for capital accumulation. It has been estimated that from 1815 to 1835 government expenditure in Britain actually fell and from 1835-60 the rise in government expenditure was only approximately 10% of the national income of Britain.(8) Many of the government measures in the economic sphere were in fact designed to eliminate feudal legal restrictions on production and the movement of capital. Thus in Britain, for example, the policy of traditional firms holding privileged monopolies was abandoned in the early nineteenth century. Instead state action tended to boost investment by lowering risks for investors, culminating in the 1862 Act which limited the liability of shareholders for the debts of any firm only to the amount they had invested in it. At the same time, the state, in response to the class struggle, passed laws which aided the general improvement in the working and living conditions of the proletariat. (For example, the Ten Hours Act of 1847).

Britain, as the most advanced capitalist economy in the mid-nineteenth century, was the first country to extend laissez-faire measures into the field of foreign trade. The ports of British colonies were opened to foreign goods between 1822-25 although British goods still had a lower tariff in them. In 1843 the free export of machinery was permitted whilst the tariff reforms of 1842-45 meant that almost all raw materials were allowed into Britain tariff-free. The Corn Laws were repealed in 1846 and the seventeenth century Navigation Acts were finally abolished in 1849. We have already seen that trade with foreign capitals of a lower organic composition is one of the means whereby capitals with a higher organic composition can offset the decline in the rate of profit. It is no coincidence therefore, that British capitalists in the mid-nineteenth century should be the first to advocate free trade policies – by doing so British exports could be sold above their value whilst still undercutting the prices of less advanced capitals. British exports, therefore, were in the main sold to the other developing capitalist states in Europe and the USA. Thus exports became an increasingly important part of Britain’s total national product, rising from $185 million in 1800 to $350 million in 1850.(9)

After about 1815 Britain began to export capital for investment and even by the middle of the nineteenth century capital export was greater than commodity export – the total reached by 1854 is estimated at £210 million.(10) This phenomenon provides further evidence for our thesis that capital export is one of the means for offsetting the falling rate of profit, since we can assume that in 1850 British industry had the highest organic composition in the world, and thus a higher rate of profit could be obtained by British capital investment in foreign capitals of a less advanced organic composition.(11) Thus British capital investment contributed to the accumulation of foreign capital and hence the internationalisation of capital, but once the capital of these latter countries advanced to a similar level of accumulation as Britain, the respective national capitalists began to export capital, first of all to less advanced capitalist states in Europe and later to other areas. As yet though, Britain was the only significant exporter of capital in 1850.

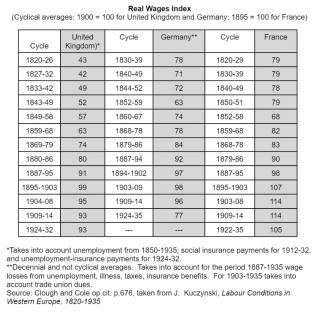

The picture of capitalism, therefore, as it existed in Europe and the United States in the mid-nineteenth century, is one of increasingly rapid accumulation which has led to an increase in the quantity and variety of commodities produced as well as an increase in the number and standard of living of the proletariat. Real wages were increasing and continued to increase until the beginning of the twentieth century (see Table I in the Appendix). Although exports were a small proportion of output, world trade was increasing rapidly,(12) reflecting the international expansion of capital. Nevertheless, the structure of capitalist firms at this time was still predominantly that of the individual entrepreneur managing his own factory.

The increasing centralisation of capital which capital accumulation necessitates led to rapid changes in the structure of firms in the second half of the nineteenth century. The first sign that the individual entrepreneur with his own business was finding it difficult to raise the necessary amount of capital which accumulation at a higher organic level demanded was the growing importance of joint-stock companies, which enabled outside investors to provide capital for a business in return for a share in the profits. With limited liability of shareholders spreading from Britain (see above) to France in 1872 and Germany between 1870-2, investing in joint-stock companies took off. In Britain the number of such companies registered increased from 8,692 in 1885 to 62,762 in 1914.(13) The rise of joint-stock companies made it possible for an even further centralisation of capital to take place in all the advanced countries of the world.

Most of the combines formed in the late nineteenth century were of a horizontal nature (cartels, syndicates, trusts, holding companies, etc.); that is, agreement or actual fusions between firms making similar products in an attempt to eliminate competition and monopolise markets for their goods. Thus by the beginning of the twentieth century a large proportion of national production in these countries was under the control of some industrial combine with a virtual monopoly of production. US capital quickly became the most centralised and concentrated since there were no legal restrictions at this time on the formation of combinations and monopolies, unlike in Europe. In 1897 there were 82 industrial combines in the US which were capitalised at about $1,000 million; by 1904 this figure had risen to 318 industrial combines, capitalised at over $7,000 million and incorporating 5,300 separate establishments.(14) By 1910 industrial combines were responsible for the production of 50% of textiles, 54% glassware, 60% cotton and printed fabrics, 62% foodstuffs, 72% beverages, 77% non-ferrous metal production, 81% chemicals and 84% of iron and steel in the USA. A more centralised capital involves a greater degree of concentration, as evidenced by the increase in the average amount of capital held by those leading companies in the United States:

In thirteen leading manufacturing industries in the USA the average amount of capital of each manufacturing plant was multiplied by thirty-nine between 1850 and 1910, and the value of the average output was multiplied by nineteen.(15)

In the single decade after 1895, 2,274 manufacturing firms in the USA were merged into just 157 corporations dominated by the “robber barons” of what was called the “Gilded Age”. Most of these corporations “dominated their industries” and enhanced the fortunes of the likes of John D. Rockefeller and J.P. Morgan.(16) However, by the turn of the century, the same tendency towards monopoly organisation of capital was manifested in other capitalist states.

Thus, in Britain between 1896 and 1901 large combines were formed in the manufacture of sewing cotton, bleaching powder, Portland cement, wallpaper, tobacco and most branches of textile finishing.(17) In Germany in 1906 there were 400 combines in existence in various diverse branches of production; in France at the beginning of the century there were syndicates in such industries as metallurgy, sugar, glass, etc. And so on, Bukharin quotes F. Laur’s figures for the beginning of the century:

... out of 500 billion franks invested in the industrial enterprises of all the countries of the world, 225 billions; i.e. almost one-half, are invested in production organised in cartels and trusts.(18)

Thus, by the turn of the century, competition in many industries had been virtually eliminated within the national economies of the most advanced capitals. This is not to say that competition had disappeared altogether among industries controlled by monopoly capital, on the contrary, international competition was now fiercer than ever. The move from predominantly individual enterprises competing within the boundaries of each capitalist state, to predominantly international competition between monopoly capitals involves a corresponding shift in the operation of the law of value and the equalisation of profit rates to a supra-national level – that is, it implies the existence of a world capitalist economy where:

The level of prices is, generally speaking, not determined by production costs as is the case in local or “national” production. To a very large extent “national” and local differences are levelled out in the general resultant of world prices which, in their turn, exert pressure on individual producers, individual countries, individual territories.(19)

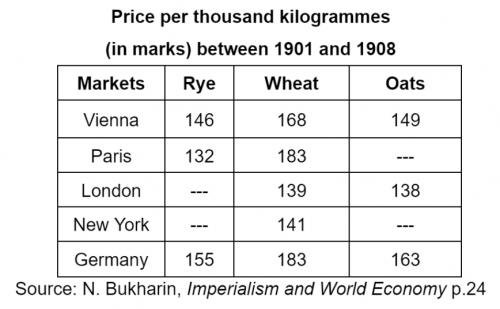

Bukharin illustrates this tendency towards global equalisation of prices by quoting the price of corn in various areas of the globe which, despite wide variations in the conditions of grain production, show a relatively small range of price differences.

In other words, international competition between monopoly capitals implies a certain interdependence between the various national capitalist states, as manifested by the expansion of world trade, the existence of the world market and the so-called world division of labour. Once the world economy exists and the law of value operates on an international level, then the concept of global capital has become a reality and with it comes the world proletariat.

From the standpoint of capital, on the other hand, the growth of the world economy and the international competition between national monopoly capitals means the rise of imperialism. By ‘imperialism’ we do not mean war, conquest or annexation in general – such a definition, as Bukharin pointed out, in Imperialism and World Economy, “explains” everything – from the conquest policy of Alexander the Great to that of Russia and the US in Vietnam. The epoch of imperialism represents an entirely new stage in capitalist development which results above all from the international competition between national capitals with the highest organic composition of capital. In so doing we are able to distinguish between the policies of the advanced capitalist states from the late nineteenth century onwards and earlier examples of war, conquest, annexation, etc. Imperialism is a specific historical category, linked to the development of the world economy, and it is to the latter which we now turn.

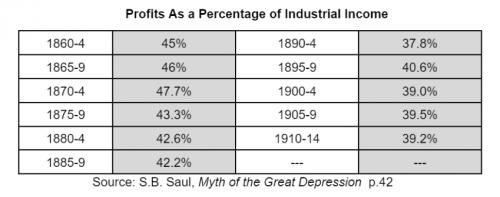

The continuing internationalising of capitalist relations from the middle of the nineteenth century which led to the development of the world capitalist economy was itself a product of the accelerated accumulation of capital and the continuing attempts to offset the declining rate of profit as the organic composition of capital increased. If we take Britain as our example, the following table shows how the general rate of profit continued to fall from 1860-1914.

Faced with an ever-diminishing rate of profit, capitals of the most advanced capitalist states relied more and more on foreign exports (exporting manufactured goods to areas of a lower organic composition and importing cheap raw materials) and capital export as a means of offsetting the decline.

Capitals invested in foreign trade are in a position to yield a higher rate of profit, because, in the first place, they come in competition with commodities produced in other countries with lesser facilities of production, so that an advanced country is enabled to sell its goods above their value even when it sells them cheaper than the competing countries. To the extent that the labour of the advanced countries is here exploited as labour of a higher specific weight, the rate of profit rises, because labour which has not been paid as being of a higher quality is sold as such. The same condition may obtain in the relations with a certain country, into which commodities are exported or from which commodities are imported. This country may offer more materialised labour in goods than it receives, and yet it may receive in return commodities cheaper than it could produce them. In the same way, a manufacturer who exploits a new invention before it has become general, undersells his competitors and yet sells his commodities above their individual values, that is to say, he exploits the specifically higher productive power of the labour employed by him as surplus value. By this means he secures a surplus profit; on the other hand, capitals invested in colonies, etc., may yield a higher rate of profit for the simple reason that the rate of profit is higher there on account of the backward development, and for the added reason that slaves, coolies [sic], etc., permit a better exploitation of labour. We see no reason why these higher rates of profit realised by capitals invested in certain lines and sent home by them should not enter as elements into the average rate of profit and tend to keep it to that extent.(20)

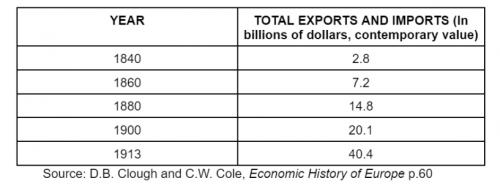

From the mid-nineteenth century to the outbreak of the First World War, world trade grew as follows:

By 1914 Britain exported about 25% of its industrial output and Germany about 20%.

At first, the development of other European capitals to the point where they were able to compete with British exports was accompanied by a movement towards free trade. During the 1860s there was a general lowering of tariffs in Europe (though not in the US). However, the growth of international competition which developed with the increasing centralisation of capital within national states quickly saw the reversal of the movement towards free trade in Europe and an increase in protectionism. Thus,

...with the increasing competition of American and Australian wheat in the 1870s, with greatly augmented industrial equipment of the western European nations, with the depressions of 1873 to 1896, a tidal wave of protectionism surged over the Continent ... Austria raised its duties in 1878, 1882, and 1888; France, in 1881, 1885, 1887, and 1892; Belgium, in 1887; Italy, in 1878, 1887, and 1891; and Russia, in 1877 and 1892.(21)

The general raising of tariff barriers from the late 1870s onwards to protect individual ‘national economies’, i.e. the home market, from foreign competition, must be seen as part of the development towards monopoly capital and the extension of capitalist competition to the world market.

Tariff barriers are thus an aspect of the development of imperialism, for they involve the strengthening of state boundaries vis-à-vis other states in the interests of monopoly capital. Moreover, tariff barriers promoted competition between foreign capitals on the world market by enabling goods sold on the home market to be sold at high prices, well above the cost of production, and those sold on the world market to be sold at much lower – sometimes below the cost of production (dumping). Such practices were the earliest signs of a significant and permanent change in the nature of capitalism; for when dumping occurs, this means that foreign trade is no longer a viable means of counteracting the falling rate of profit, for high prices on the home market merely increase the exchange value of labour power and hence the cost of production for the capitalist. (That is, assuming the workers are to maintain their living standards – in fact by the beginning of the twentieth century, real wages began to fall).

The expansion of industrial capital at the expense of agriculture in the advanced capitalist states of Europe meant an increasing reliance on the import of food stuffs (principally grain and meat) from areas where production was devoted to a single crop or kind of meat. Capital accumulation led also to the need for more raw materials for industry which were imported from less advanced or underdeveloped economies. Moreover, if these raw materials could be obtained cheaply, they lowered the costs of production and hence provided a counter-tendency to the falling rate of profit.

In 1910 the price of rubber rose from 2/9 (14p) to 12/6 (62.5p) per lb. owing to the great demand for rubber for motor tyres and the covering of electrical plant. The profits of some rubber companies rose to 200 per cent per annum as a consequence. This attracted the attention of financiers and company promoters, and very soon millions of capital were thrown into the rubber growing industry in plantations in S.America, Central Africa, India, Ceylon, etc. In time the rubber output increased and the price has fallen to the old level and even below it to 2/6 (12.5p). The same happened in the case of oil for motors. It ought to be noted that this rush to the torrid zone for raw materials was one of the many economic factors leading to the feverish secret diplomacy that ultimately landed Europe in the present world war.(22)

Thus the search for cheap raw materials was bound up with the increasing rivalry between European states for control over, and annexation of, previously undeveloped areas – as evidenced by the extent to which territories which contained important mineral deposits were annexed, and by the seizure and development of monocultural agricultural areas after about 1870.

Another aspect of the internationalisation of the capitalist mode of production in the late nineteenth century, which stemmed from capital’s attempts to maximise profits and offset the declining rate of profit, was the increasing rate of export of capital from those states with the highest organic composition to areas with a lower organic composition – in other words, to places where a higher rate of profit could be obtained. We have seen how Britain, as the state with the highest organic composition of capital, had begun to export capital to France and the US by the middle of the nineteenth century. Until about 1875 British export of capital was mainly to Western Europe and the US where it contributed to the expansion of those capitals. With the accumulation of US and European capital to the point where the organic composition had turned these states into capital exporters, British capital sought more profitable areas of foreign investment, notably the Empire and Latin America. It has been calculated(23) that from 1900 to 1904 the average rate of returns offered by borrowers in London for large potential investors was 3.18% on home issues, 3.33% on colonial, and 5.39% on foreign. By 1913, 47% of British foreign investments were in the Empire, 20% in the US and 20% in Latin America, and Britain was by far the biggest exporter of capital in the world. By 1914 total British overseas exports were worth over £3,700 million (mainly railways: 40%, government and municipal loans: 30%, and raw material production: 10%). Nevertheless, in the latter half of the nineteenth century, first French, and then German capital became the chief competition with British capital for more profitable areas of investment in less developed countries. By 1880 French foreign investments had reached £595 million and that figure was to increase threefold by 1914. Half of the latter total was invested in Europe – again, mainly the less advanced states in Central and Eastern Europe, with a further 17% in the US and another 17% in Latin America.(24)

Foreign investments, therefore, played an important role in the internationalising of capital and the development of the world economy. But, as Bukharin pointed out, the internationalising of capital does not coincide with the internationalising of the interests of capital, and the increased rate of capital export, like the increase in foreign trade, was of necessity accompanied by a sharpening of hostile relations between the most advanced powers as competition increased for control over actual and potential investment zones. The interests of investors in “backward” areas were ultimately secured by the threat or use of military force (e.g. colonisation of Tunis by France after default, or Egypt by Britain after defaults).

It can be seen from this brief outline that the development of the world economy and the development of imperialism are inextricably linked.

Thus, together with the internationalisation of economy and the internationalisation of capital, there is going on a process of “national” intertwining of capital, a process of “nationalising” capital, fraught with the greatest consequences.(25)

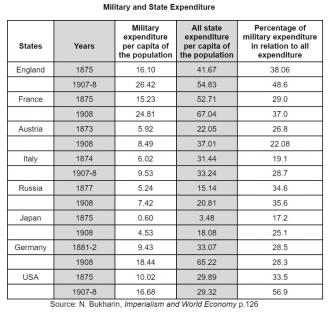

The attempts by the highly centralised capitals to offset the decline in the rate of profit, which had led to the internationalising of capitalist relations to the point where capitalism had become a global system, had also led to the increasing nationalisation of capital (increase in protectionism, etc.) to the point where capitalist competition was competition between the advanced states for control over the rest of the world. Such inter-imperialist competition necessitates the existence of powerful military forces to ‘back up’ the purely economic competition, not only with regard to the weaker, under-developed economies, but ultimately to determine the outcome of direct conflict between the most advanced powers. From 1850 onwards the cost of armaments production increased annually as competition between the advanced capitalist states increased, resulting in the arms race of 1890-1914. During these years military expenditure was the largest single item of government expenditure (which was itself increasing) in all the advanced states. The table below shows the increase in government expenditure on arms for eight advanced states from 1875 to 1908.

By 1914, Britain’s total military expenditure has been estimated as £77,029,300; Germany: £97,845,960; France: 1,717,202,233 francs; Russia: 825,946,421 rubles; USA: $313,204,990.(26)

World war is the inevitable outcome of such inter-imperialist competition.

If our analysis of ascendant capitalism appears to draw a picture of a ‘smooth’, straightforward expansion, then let us emphasise again that accumulation occurred within the context of cut-throat competition and the so-called “business cycle” of boom – slump – recovery; where each period of slump ensured that the least competitive enterprises were bankrupted and taken over by their higher organic competitors. The subsequent “recovery” made possible by the devaluation of capital (as a result of a general fall in prices) was on the basis of an ever more concentrated and centralised capital. Given the tendency towards equalisation of profit rates as capitalism expanded, capital’s periodic crises became more uniform and widespread throughout the world. Thus, for example, England and France only shared the same phases of the cycle in 28% of the years between 1840-82, but they shared it in 65% of the years between 1882-1925; whilst seventeen countries analysed after the turn of the century showed almost identical patterns of crisis and recovery.(27)

Just as the crisis became more extensive, so each one in succession wracked the system more deeply. Because, as we explained above, each crisis led to a greater concentration and centralisation of capital, in each successive crisis there were fewer competitors to go to the wall. Ultimately this centralisation of capital proceeded to the point where, within each national capital, the interests of monopoly capitalism became intertwined with the State. Now capitalist competition, which had hitherto appeared to offer humanity the real possibility of abundance, led to a restrictive curbing of the forces of production as each state sought to protect its national capital. As we shall see, capitalism was now a decadent social system and its further existence could only be obtained by plunging the world into the first global conflict between nation states.

ERCommunist Workers’ Organisation

Appendix

Notes:

(1) Capital Volume 1 (Penguin Classics 1990) p. 874

(2) op.cit p. 915

(3) See H.W. French Born in Blackness (Liveright 2021) p.175

(4) Capital Volume 1 p. 926

(5) Manifesto of the Communist Party (1975, Peking Edition) p.40

(6) Paul Mattick The Permanent Crisis – Henryk Grossman’s Interpretation of Marx’s Theory Of Capitalist Accumulation, marxists.org

(7) Capital Volume 1 p. 929

(8) W. Ashworth A Short History of the International Economy, 1850-1950 pp.131-132

(9) The Fontana Economic History of Europe, Vol. IV p.670

(10) Ashworth, op.cit. p.170

(11) In fact this is a recurring pattern throughout capitalist history. The British were not the first to export capital to a more dynamically productive nation. Dutch mercantile capital facing a small productive economy at home financed much of the industrial revolution in the UK. The same pattern would be repeated in the UK’s financing of the accumulation of capital in the USA until that too overtook its sponsoring capital. Something similar has happened in the present epoch since the crisis of the 1970s, with US capital having created a commercial rival in China. The difference with the latter though is that the capitalist context has now changed and in the epoch of imperialism there is unlikely to be a repeat of the previous peaceful reconciliations to the new situation.

(12) One estimate is from £280 million in 1800 to £380 million in 1830 to £800 million by 1850. See Ashworth op.cit. p.30

(13) op.cit. p.94

(14) op.cit. p.96

(15) op.cit. p.69

(16) Timothy Wu, The Curse of Bigness (Columbia Global Reports, 2018) pp.24-5

(17) Ashworth op.cit. p.96

(18) N. Bukharin, Imperialism and World Economy, p.69

(19) op.cit. p.23

(20) Marx, Capital Volume III, p.238 (Lawrence and Wishart, 1974)

(21) D.B. Clough and C.W. Cole, Economic History of Europe, p.610-611

(22) John Maclean, The War after the War, p.8

(23) By A. Cairncross, see Ashworth op.cit. p.171

(24) Figures from Ashworth op.cit. pp.173-174 and Clough and Cole op.cit. pp.657-661

(25) Bukharin op.cit. p.80

(26) loc.cit. p.126

(27) Quoted from O. Schwarz “Finanzen der Gegenwart” in Handworterbuch der Staatswissen. Bukharin points out “... that the author’s figures of German and Austrian expenditures are incorrect, for they do not include the extraordinary budgets and the appropriations made only once; the figures for the USA do not include the “civil expenditure” of the individual states, so that the increase (33.5-56.9) is in reality much larger.”

Revolutionary Perspectives

Journal of the Communist Workers’ Organisation -- Why not subscribe to get the articles whilst they are still current and help the struggle for a society free from exploitation, war and misery? Joint subscriptions to Revolutionary Perspectives (3 issues) and Aurora (our agitational bulletin - 4 issues) are £15 in the UK, €24 in Europe and $30 in the rest of the World.

Revolutionary Perspectives #21

Start here...

- Navigating the Basics

- Platform

- For Communism

- Introduction to Our History

- CWO Social Media

- IWG Social Media

- Klasbatalo Social Media

- Italian Communist Left

- Russian Communist Left

The Internationalist Communist Tendency consists of (unsurprisingly!) not-for-profit organisations. We have no so-called “professional revolutionaries”, nor paid officials. Our sole funding comes from the subscriptions and donations of members and supporters. Anyone wishing to donate can now do so safely using the Paypal buttons below.

ICT publications are not copyrighted and we only ask that those who reproduce them acknowledge the original source (author and website leftcom.org). Purchasing any of the publications listed (see catalogue) can be done in two ways:

- By emailing us at uk@leftcom.org, us@leftcom.org or ca@leftcom.org and asking for our banking details

- By donating the cost of the publications required via Paypal using the “Donate” buttons

The CWO also offers subscriptions to Revolutionary Perspectives (3 issues) and Aurora (at least 4 issues):

- UK £15 (€18)

- Europe £20 (€24)

- World £25 (€30, $30)

Take out a supporter’s sub by adding £10 (€12) to each sum. This will give you priority mailings of Aurora and other free pamphlets as they are produced.

ICT sections

Basics

- Bourgeois revolution

- Competition and monopoly

- Core and peripheral countries

- Crisis

- Decadence

- Democracy and dictatorship

- Exploitation and accumulation

- Factory and territory groups

- Financialization

- Globalization

- Historical materialism

- Imperialism

- Our Intervention

- Party and class

- Proletarian revolution

- Seigniorage

- Social classes

- Socialism and communism

- State

- State capitalism

- War economics

Facts

- Activities

- Arms

- Automotive industry

- Books, art and culture

- Commerce

- Communications

- Conflicts

- Contracts and wages

- Corporate trends

- Criminal activities

- Disasters

- Discriminations

- Discussions

- Drugs and dependencies

- Economic policies

- Education and youth

- Elections and polls

- Energy, oil and fuels

- Environment and resources

- Financial market

- Food

- Health and social assistance

- Housing

- Information and media

- International relations

- Law

- Migrations

- Pensions and benefits

- Philosophy and religion

- Repression and control

- Science and technics

- Social unrest

- Terrorist outrages

- Transports

- Unemployment and precarity

- Workers' conditions and struggles

History

- 01. Prehistory

- 02. Ancient History

- 03. Middle Ages

- 04. Modern History

- 1800: Industrial Revolution

- 1900s

- 1910s

- 1911-12: Turko-Italian War for Libya

- 1912: Intransigent Revolutionary Fraction of the PSI

- 1912: Republic of China

- 1913: Fordism (assembly line)

- 1914-18: World War I

- 1917: Russian Revolution

- 1918: Abstentionist Communist Fraction of the PSI

- 1918: German Revolution

- 1919-20: Biennio Rosso in Italy

- 1919-43: Third International

- 1919: Hungarian Revolution

- 1930s

- 1931: Japan occupies Manchuria

- 1933-43: New Deal

- 1933-45: Nazism

- 1934: Long March of Chinese communists

- 1934: Miners' uprising in Asturias

- 1934: Workers' uprising in "Red Vienna"

- 1935-36: Italian Army Invades Ethiopia

- 1936-38: Great Purge

- 1936-39: Spanish Civil War

- 1937: International Bureau of Fractions of the Communist Left

- 1938: Fourth International

- 1940s

- 1960s

- 1980s

- 1979-89: Soviet war in Afghanistan

- 1980-88: Iran-Iraq War

- 1980: Strikes in Poland

- 1982: First Lebanon War

- 1982: Sabra and Chatila

- 1986: Chernobyl disaster

- 1987-93: First Intifada

- 1989: Fall of the Berlin Wall

- 1979-90: Thatcher Government

- 1982: Falklands War

- 1983: Foundation of IBRP

- 1984-85: UK Miners' Strike

- 1987: Perestroika

- 1989: Tiananmen Square Protests

- 1990s

- 1991: Breakup of Yugoslavia

- 1991: Dissolution of Soviet Union

- 1991: First Gulf War

- 1992-95: UN intervention in Somalia

- 1994-96: First Chechen War

- 1994: Genocide in Rwanda

- 1999-2000: Second Chechen War

- 1999: Introduction of euro

- 1999: Kosovo War

- 1999: WTO conference in Seattle

- 1995: NATO Bombing in Bosnia

- 2000s

- 2000: Second intifada

- 2001: September 11 attacks

- 2001: Piqueteros Movement in Argentina

- 2001: War in Afghanistan

- 2001: G8 Summit in Genoa

- 2003: Second Gulf War

- 2004: Asian Tsunami

- 2004: Madrid train bombings

- 2005: Banlieue riots in France

- 2005: Hurricane Katrina

- 2005: London bombings

- 2006: Anti-CPE movement in France

- 2006: Comuna de Oaxaca

- 2006: Second Lebanon War

- 2007: Subprime Crisis

- 2008: Onda movement in Italy

- 2008: War in Georgia

- 2008: Riots in Greece

- 2008: Pomigliano Struggle

- 2008: Global Crisis

- 2008: Automotive Crisis

- 2009: Post-election crisis in Iran

- 2009: Israel-Gaza conflict

- 2020s

- 1920s

- 1921-28: New Economic Policy

- 1921: Communist Party of Italy

- 1921: Kronstadt Rebellion

- 1922-45: Fascism

- 1922-52: Stalin is General Secretary of PCUS

- 1925-27: Canton and Shanghai revolt

- 1925: Comitato d'Intesa

- 1926: General strike in Britain

- 1926: Lyons Congress of PCd’I

- 1927: Vienna revolt

- 1928: First five-year plan

- 1928: Left Fraction of the PCd'I

- 1929: Great Depression

- 1950s

- 1970s

- 1969-80: Anni di piombo in Italy

- 1971: End of the Bretton Woods System

- 1971: Microprocessor

- 1973: Pinochet's military junta in Chile

- 1975: Toyotism (just-in-time)

- 1977-81: International Conferences Convoked by PCInt

- 1977: '77 movement

- 1978: Economic Reforms in China

- 1978: Islamic Revolution in Iran

- 1978: South Lebanon conflict

- 2010s

- 2010: Greek debt crisis

- 2011: War in Libya

- 2011: Indignados and Occupy movements

- 2011: Sovereign debt crisis

- 2011: Tsunami and Nuclear Disaster in Japan

- 2011: Uprising in Maghreb

- 2014: Euromaidan

- 2016: Brexit Referendum

- 2017: Catalan Referendum

- 2019: Maquiladoras Struggle

- 2010: Student Protests in UK and Italy

- 2011: War in Syria

- 2013: Black Lives Matter Movement

- 2014: Military Intervention Against ISIS

- 2015: Refugee Crisis

- 2018: Haft Tappeh Struggle

- 2018: Climate Movement

People

- Amadeo Bordiga

- Anton Pannekoek

- Antonio Gramsci

- Arrigo Cervetto

- Bruno Fortichiari

- Bruno Maffi

- Celso Beltrami

- Davide Casartelli

- Errico Malatesta

- Fabio Damen

- Fausto Atti

- Franco Migliaccio

- Franz Mehring

- Friedrich Engels

- Giorgio Paolucci

- Guido Torricelli

- Heinz Langerhans

- Helmut Wagner

- Henryk Grossmann

- Karl Korsch

- Karl Liebknecht

- Karl Marx

- Leon Trotsky

- Lorenzo Procopio

- Mario Acquaviva

- Mauro jr. Stefanini

- Michail Bakunin

- Onorato Damen

- Ottorino Perrone (Vercesi)

- Paul Mattick

- Rosa Luxemburg

- Vladimir Lenin

Politics

- Anarchism

- Anti-Americanism

- Anti-Globalization Movement

- Antifascism and United Front

- Antiracism

- Armed Struggle

- Autonomism and Workerism

- Base Unionism

- Bordigism

- Communist Left Inspired

- Cooperativism and autogestion

- DeLeonism

- Environmentalism

- Fascism

- Feminism

- German-Dutch Communist Left

- Gramscism

- ICC and French Communist Left

- Islamism

- Italian Communist Left

- Leninism

- Liberism

- Luxemburgism

- Maoism

- Marxism

- National Liberation Movements

- Nationalism

- No War But The Class War

- PCInt-ICT

- Pacifism

- Parliamentary Center-Right

- Parliamentary Left and Reformism

- Peasant movement

- Revolutionary Unionism

- Russian Communist Left

- Situationism

- Stalinism

- Statism and Keynesism

- Student Movement

- Titoism

- Trotskyism

- Unionism

Regions

User login

This work is licensed under a Creative Commons Attribution 3.0 Unported License.